Payroll - Do you maximize your Superannuation benefits? (Australia only)

Last updated by Tiago Araújo [SSW] about 1 year ago.See historyMost people show little interest in their superannuation because it feels so distant in the future. That is a mistake!

Superannuation is more than just a retirement savings account - it's a long-term investment that benefits greatly from the power of compound interest, strategic salary sacrifice, and good fund management. Use these tools and strategies to maximize your financial future!

Video: How to maximize your Superannuation | Stephan Fako (5 min)

Let’s break it down by exploring 3 key aspects you need to understand:

- How compounding and interest rates affect your investment return

- How to grow Super through salary sacrifice (going beyond the mandatory 11.5% in 2025 and 12% in 2026)

- How to check your Super fund is giving you strong returns

What is Superannuation?

Superannuation (Super) is a compulsory retirement savings system in Australia. Your employer makes contributions on your behalf, which are invested and managed by your chosen Super fund until retirement.

1. The power of compound interest

You may have heard people say that the sooner you start saving, the better off you'll be. That’s because of compound interest.

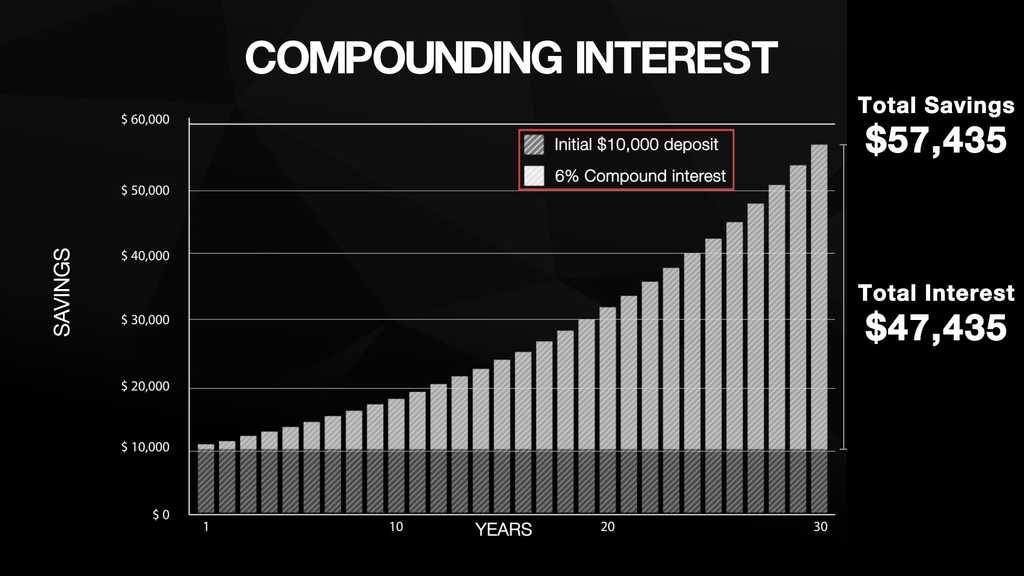

Compound interest occurs when your initial investment earns interest, and then that interest also earns interest. Over time, this snowball effect can significantly increase your returns. Since Superannuation is a long-term investment, the impact of compound interest can multiply your funds over decades.

If you would like to find out more on the types of interest, check out Investopedia’s website.

How even a small return rate difference (say 1%) impacts you

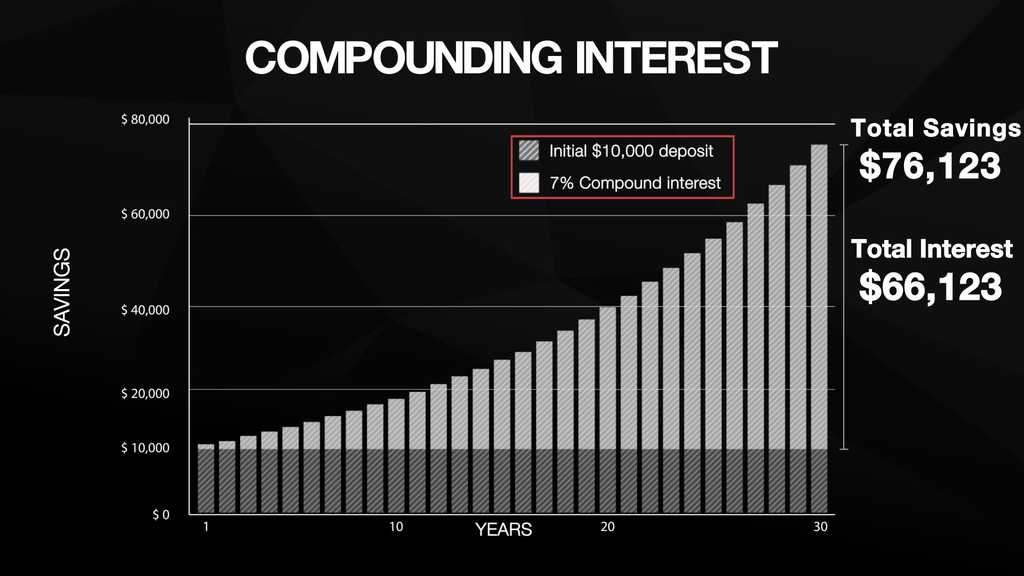

Investment return (interest) rates play a significant role in driving the growth of your Superannuation balance over time. Even small differences in rates can have a significant impact on your retirement savings over a decade, so understanding how return rates affect your Super is crucial.

When investment returns are higher, your Super fund’s investments generate more returns. Compounding these returns over a decade leads to substantial growth in your Super balance.

Conversely, a lower return rate reduces the speed at which your Super balance grows. Although your investment still benefits from compounding, the overall growth is more modest compared to higher rates.

2. Increasing Super balance through salary sacrifice

Another great way to boost your Super balance is to go beyond the mandatory 11.5% (FY 2025) contribution (aka Super Salary Sacrifice). This strategy allows you to contribute additional funds to your Super from your pre-tax salary.

Super Salary Sacrifice offers 2 key benefits:

✅ Tax Savings - Your salary sacrifice contributions are taxed at 15%, which is much lower than the top tax rate of 45% (that is 30% lower than your marginal income tax rate)

✅ Super Boost - Extra contributions into Super lead to faster compounding growth

Warning: The important thing to remember with Super is that your contributions are subject to the Superannuation Contributions Cap. The Cap is $30,000 per year in FY2025, but it changes over time. It’s essential to check the current Cap each year.

3. How to choose the right Super investment option

Understanding the impact of compounding and return rates helps you compare your Super fund returns to a benchmark or assess alternate investment options.

Super funds typically offer a variety of investment choices, each with different levels of risk and return. The level of risk you're comfortable with depends on your risk tolerance - your ability and willingness to take on risk in exchange for potential rewards.

When selecting an investment option, it’s important to align your choice with both your risk tolerance and the time left until retirement. Here’s a breakdown of the most common investment options offered by Super funds:

- Conservative - Lower risk, lower potential returns. These investments focus on stable assets like cash and bonds

- Balanced - A mix of growth and conservative investments. Suitable for those with moderate risk tolerance

- Growth/Aggressive - Higher risk, higher potential returns. These options invest more heavily in shares and property

- Socially Aware - Varies in risk and returns. Focuses on ethical and sustainable investments. Best for those wanting to align investments with their values

- Direct Investment - Customizable risk and returns. You choose individual shares, ETFs, and term deposits. Best for experienced investors wanting control over their portfolio

Finding the best Super fund for you

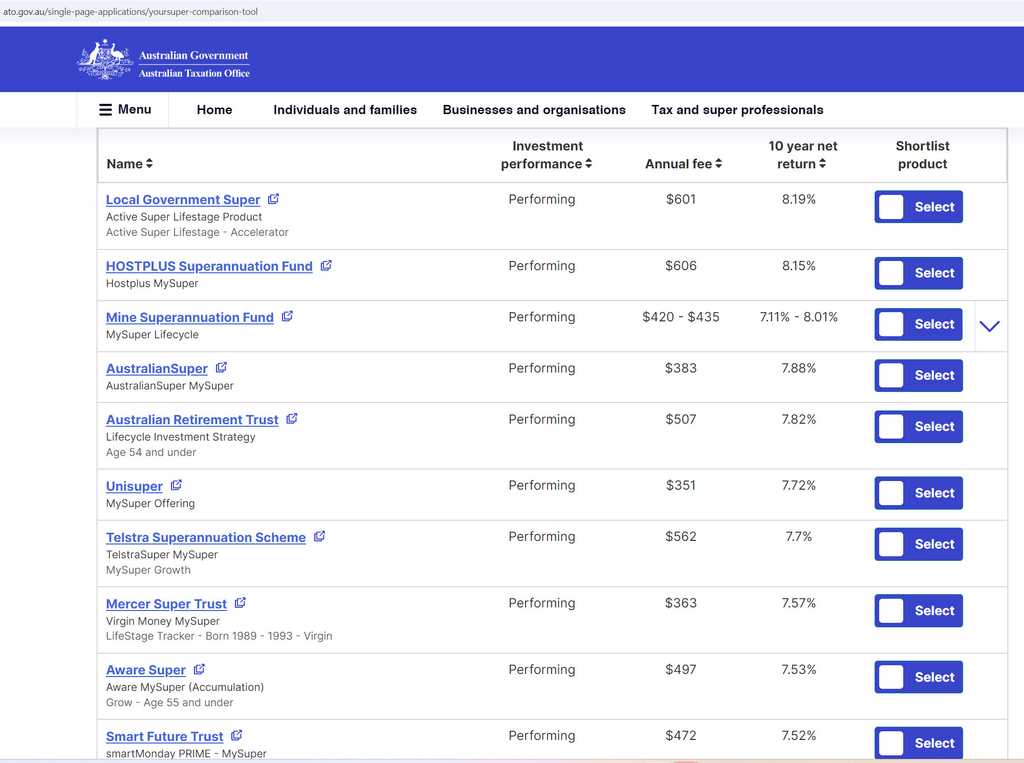

Choosing the right Super fund can make a big difference in your retirement balance. Before making any decisions, consider fees, investment options, and investment performance, etc.

Use the ATO's Super Comparison Tool to compare Super funds and find one that suits your needs.

Warning: Performances change so look at it once a year.

How to rollover into a different Super fund

Rolling over your Superannuation to a different fund can be a smart move, especially if you're looking for lower fees or better performance. The process is relatively simple, and here's how:

1. Compare Super Funds

Before rolling over your Super, it's important to compare different Super funds to ensure you’re choosing the one that best fits your needs. Look for:

- Fees - Lower fees mean more money stays in your Super

- Performance - Check past performance, but remember, it doesn’t guarantee future results

- Investment options - Make sure the fund offers investment choices that align with your risk tolerance and goals

Tip: You can use the ATO Super Comparison Tool (previously mentioned) to help compare funds.

2. Check for exit fees and insurance

Some Super funds may charge exit fees, although many have been phased out. Additionally, check if you have any insurance attached to your existing fund, as this may not automatically transfer. Ensure your new fund offers adequate insurance coverage if needed.

3. Rollover

Once you’ve chosen a new fund, follow these steps to roll over your Super:

- Log in to MyGov - If you have a MyGov account linked to the ATO, you can initiate the rollover online

- Complete a Rollover Form - Alternatively, you can fill out a form provided by your new Super fund. They may also offer an online service to handle the rollover on your behalf

- Email your employer - With your new fund details and membership number

Bonus: Using Super to buy your first home (Salary Sacrificed amount)

A cool thing to consider if you have never owned a property in Australia. The First Home Super Saver Scheme (FHSSS) allows eligible first-time home buyers to access their salary sacrificed Super contributions to help purchase a home. Here’s how it works (in FY25):

- Eligibility - You must be a first-time home buyer and meet the FHSSS requirements

- Salary Sacrifice contributions - You can access up to $15,000 of salary sacrificed Super contributions per year, and a maximum of $50,000 in total

- Tax benefits - Contributions are taxed at 15%, often lower than your regular income tax rate, helping you save faster

- Withdrawal process - You can apply to release these funds through the ATO when you're ready to buy your home

- Timing - You must sign a contract to buy or build within 12 months of requesting the release

This strategy can help you save for a deposit faster, while still benefiting from tax savings within Super.

Check out ATO’s website for further information on the First Home Super Saver Scheme.

Maximize your financial future

Remember, even small adjustments today can lead to big rewards down the road. Whether you’re comparing funds, adjusting your risk level, or considering salary sacrifice, each step brings you closer to a more comfortable retirement.

Before making decisions about your financial future, don’t forget to seek independent professional advice.