Expenses - Do you understand the difference between Tax Invoice and Eftpos Receipt?

Last updated by Suzanne Gibson [SSW] 11 months ago.See historyWhen you make purchases in-store by card, you typically receive 2 receipts: Tax Invoices and Eftpos Payment Receipts. They might seem like two peas in a pod, but they're different creatures serving different purposes. It is important to distinguish the difference between a Tax Invoice and Eftpos Payment Receipt—but let's be honest, the difference confuses most of us!

The primary purpose of a Tax Invoice is to provide a comprehensive record of a transaction for tax and accounting purposes. While an Eftpos Payment Receipt is like a digital high-five after you've paid for something using Eftpos. It's a record saying, "Yep, the payment went through!"

If you're not sure which papers you need, just keep everything. It's way better to have too many records than miss out on something important.

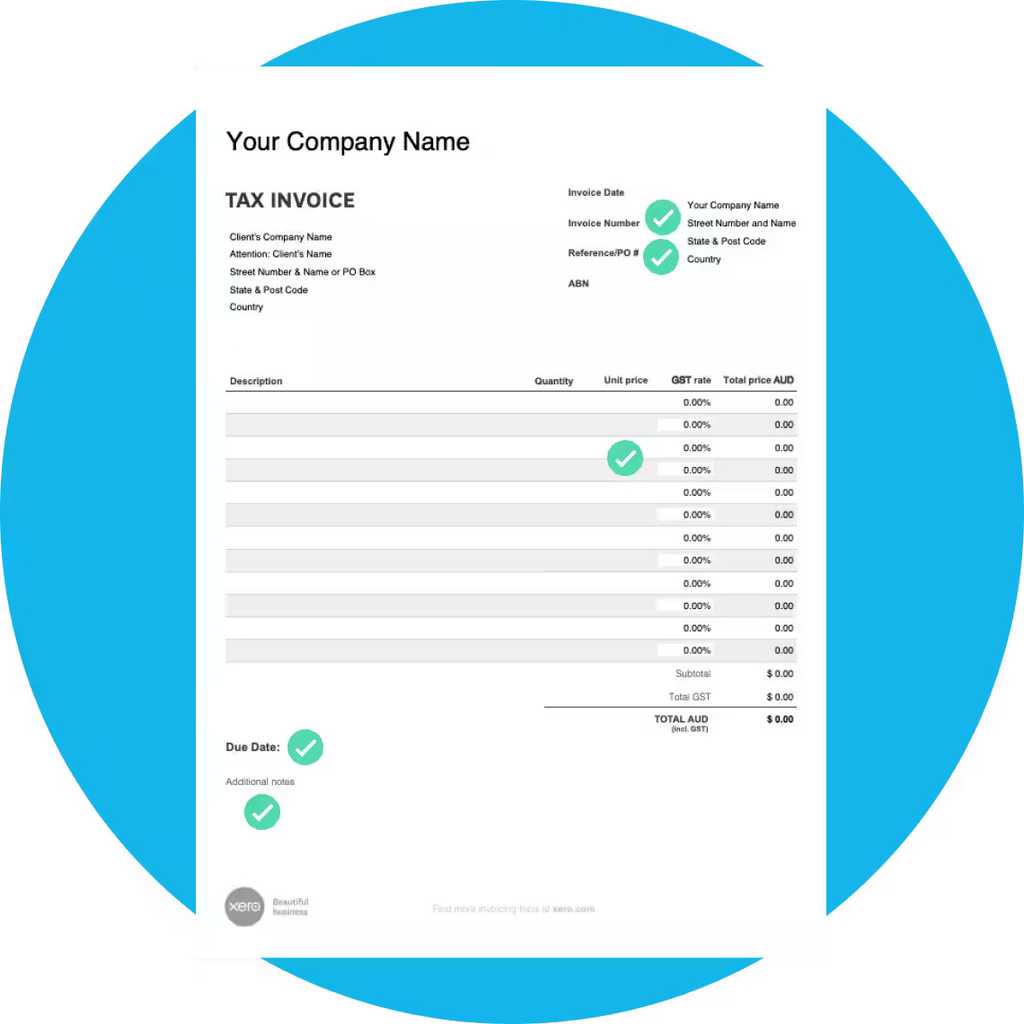

Tax Invoice

An official document issued by a seller to a buyer, detailing the products or services provided along with their respective prices. It is a legal requirement for businesses to issue tax invoices for taxable sales. A tax invoice would normally have the following:

Business Information

- Seller's info – Name, address, and contact details

- Buyer's info – Name and address

Invoice Details

- Invoice number

- Date – When the invoice was created

Product/Service Information

- Description – The products or services

- How much – Quantity, unit price, and total amount

Tax Information

- Tax – Goods and Services Tax (GST) details

- Total amount (including GST)

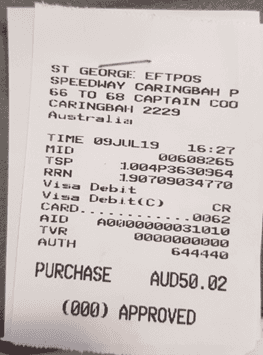

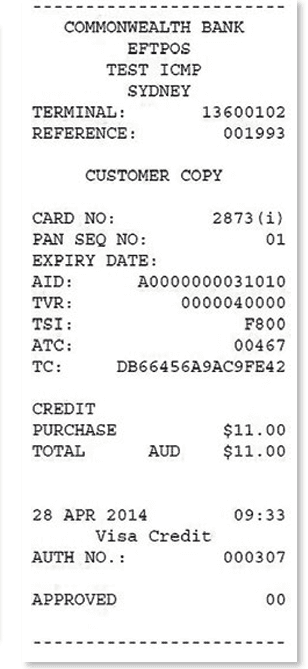

Eftpos Payment Receipt

An Eftpos Payment Receipt is a document confirming that a payment has been made through an Electronic Funds Transfer at Point of Sale (Eftpos) system. It acknowledges the successful completion of a transaction.

It usually shows information:

Transaction Details

- When – Date and time of the transaction

- How – Payment method and card type

Business Information

- Who – Merchant's name and contact information

Amount Information

- How much – Total amount paid

- Approved or declined – Confirmation of payment

Spot the difference

| Purpose | Content | Legal Requirement | |

|---|---|---|---|

| Tax Invoice | Primarily for tax and accounting purposes | Detailed information on products/services, taxes, and payment terms | Often required by tax authorities for proper documentation |

| Eftpos Payment Receipt | Confirmation of payment | Focuses on transaction details, amount, and payment method | Serves as a customer receipt, not always legally mandated |

For businesses, maintaining tax invoices is a must for keeping solid accounting records and claiming tax or GST.

Eftpos payment receipt is helpful and supplementary, especially when you've paid more than the invoiced amount (such as credit card surcharges).

However, it's essential to note that while the Eftpos receipt confirms payment, it can't replace the role of a tax invoice.

The invoice is the official record that details why and where you spent that money, making it irreplaceable for comprehensive documentation.