Rules to Better Accounting - 33 Rules

Streamline accounting practices by implementing essential rules that enhance operational efficiency and financial accuracy. Discover strategies for effective payroll management, expense tracking, and ensuring compliance within your organization.

Are you planning to buy a cool laptop to boost your productivity? You can place your order from Apple or JB HiFi at full price. Or if your employer offers the ability to Salary Sacrifice, you can spend less by paying with your pre-tax money (rather than after-tax).

Video: Pay Less Tax with Salary Sacrificing! | Electronic Devices (4 min)What is salary sacrificing for electronic devices

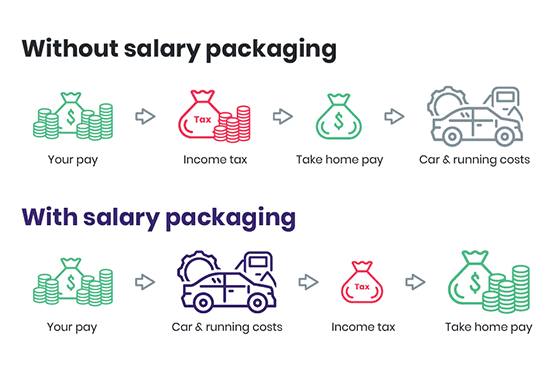

In Australia, salary sacrificing is when your employer agrees to pay for your device(s) with your pre-tax salary, therefore you pay less tax.

Most companies will let you salary sacrifice FBT-exempted (Fringe benefit tax) portable electronic devices that:

- Are used predominantly for work-related purposes

- Are easily portable and designed for use away from an office environment

- Are small and light

- Can operate without an external power supply

- Are designed as a complete unit

This provides you with a wide variety of work-related devices that you could salary sacrifice and save money on. Some devices such as laptops, tablets, phones, and headphones are just some of the examples.

Accessories (such as cases and chargers) can be included in a salary sacrifice arrangement only if they are necessary for the basic operation of the electronic device. Accessories bundled into the price by the retailer can be included in the arrangement.

The benefits of salary sacrifice

Salary sacrificing has many awesome benefits:

✅ You pay for your devices in pre-tax dollars (a saving of approximately 30% depending on your tax bracket)

✅ You don’t pay GST (saving you another 10%)

✅ Less admin - Nothing for you to do at tax time

✅ You get to choose your device - and you own it

✅ You can get something with more powerful than you could have without the savings

Tip: As an added benefit, both you and your company can coordinate to incorporate some branding into the asset through salary sacrifice.

Scenario

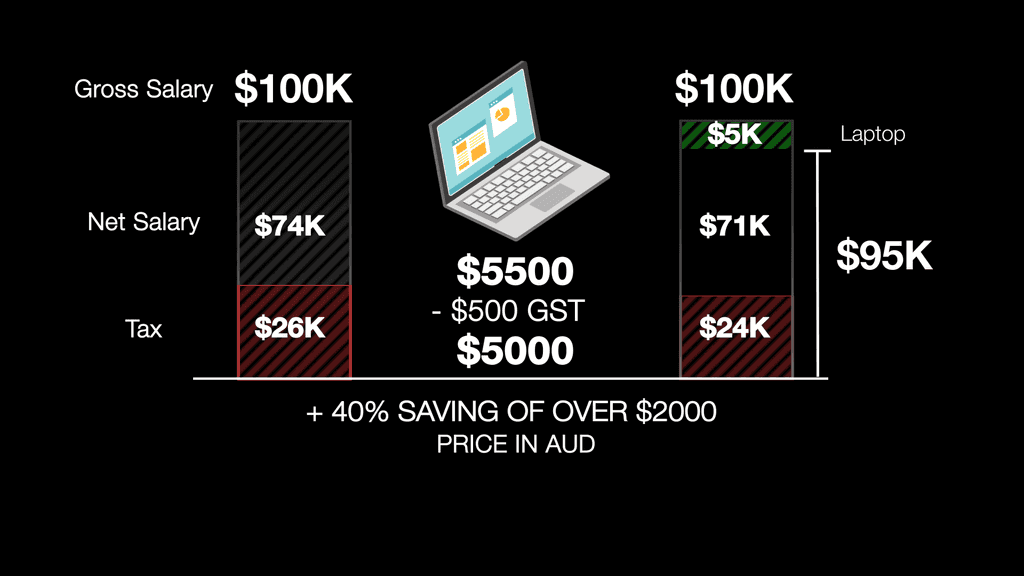

Bob is earning $111k per annum (salary package inclusive of $11k Super). He wants to buy a $5,500 laptop.

Let's look at how he saves $2,500 on the new laptop.

Figure: Without Salary Sacrificing vs Salary Sacrificing ❌ Without Salary Sacrificing ✅ With Salary Sacrificing Salary package inclusive of Super $ 111k $ 111k Less Super $ 11k $ 11k Pre-tax deduction $ 0 $ 5k Gross Income $ 100k $ 95k Less Tax $ 26k $ 24k 💻 Purchase $ 5k $ 0 💻 GST on Purchase $ 0.5k $ 0 Take-home pay $ 68.5k $ 71k Figure: Bob saved $2,500 on take-home pay with salary sacrificing

According to the Association of Certified Fraud Examiners' 2024 report, organizations lose an estimated 5% of their revenue to fraud each year.

In Australia, cybercriminals are increasingly targeting businesses, leading to global losses of up to $2.9 billion annually.

Accountants and accounts payable professionals are prime phishing targets due to their access to financial transactions, and some may lack cybersecurity awareness.Scammers exploit this through fake invoices, compromised emails, and fraudulent bank detail changes

It always requires extra care and diligence on money, accountants can follow the suggestions below to mitigate these risks.

- Recognizing Phishing URLs

Phishing emails often contain malicious links that can lead to fraudulent websites.

See SSW Rule - Do you know how to recognize phishing URLs?

- Preventing Email Compromise & Fraudulent Payments

Attackers often hack business emails to send fake payment requests or change bank details.

• Enable MFA - Be careful to manage your passwords and always use Multi-factor authentication

See SSW Rule - Do you use MFA and avoid typing passwords?

• Use security tools - Use email security tools (e.g., Microsoft Defender).

• Verify changes by phone - Always call a known contact using a verified number before processing any changes. Never trust phone numbers from emails requesting updates.

Paying a supplier - confirm the bank details by calling the creditor's verified number for the first payment (over $1,000) or if there is a change in bank details.

Figure: Good Examples

• Monitor email forwarding rules - Hackers may set up auto-forwarding to steal sensitive information. Regularly review and disable unauthorized forwarding.

- Adding an Invoice Disclaimer to prevent Fraud

Including a disclaimer on invoices can help prevent phishing attacks that aim to alter billing details.

• Authorized domain only - Clearly state that all official communication, including billing and invoices, will only come from a specific domain (e.g., @company.com).

• Changes only come from verified channels - Any changes in payment details will only be communicated through verified channels, such as a notification with the company seal or a direct phone call from an authorized representative

Example:

To ensure the security of your payments, please be aware that SSW will never request changes to our bank details via email. All official communications regarding billing details will only come from emails originating from our authorized domain: @ssw.com.au.

✅ Good Example

It's great when someone can solve problems quickly and professionally. However, the knowledge and skills on how to solve problems related to the role needs to be documented so anyone can follow.

Keep that knowledge in the cloud and create procedures that can be shared to individuals who might not have your knowledge and experience.

This can be beneficial in different ways:

- Continuity: When knowledge is tied to a role, it is less likely to be lost if the person in that role leaves the organization. This helps to ensure that essential processes and procedures continue to be carried out effectively

- Scalability: By keeping knowledge in the cloud, it becomes easier to train new hires or skill up a team. Rather than relying on the expertise of a single individual, the organization can draw on a shared pool of knowledge and skills

- Resilience: It helps to create a more resilient organization, as the loss of a key individual will have less of an impact. This can help to mitigate risks and minimize disruption

- Transferability: It becomes easier to transfer knowledge to other individuals within the organization. This can help to foster a culture of learning and continuous improvement

Keep in mind that every task is tied to a role, a position or a duty, rather than a specific person. This ensures that the organization has access to the knowledge it needs to achieve its goals and objectives, even as personnel change over time.

Companies often lose sight of their financial health due to disorganized processes or lack of regular oversight. This can lead to missed opportunities, unnecessary spending, or even financial instability.

Monthly financial meetings help mitigate these risks by providing clarity, accountability, and actionable insights into your business's performance.

In these meetings, key staff members should review the past month and look at forecasts for next month.

It is a good idea to split reporting responsibilities into two sections:

- Sales Team - Responsible for preparing sales reports, utilization metrics, and billable leaderboards

- Accounting Team - Responsible for generating financial reports, select KPIs, forecasting and trend analysis

Pre-meeting preparation steps

Proper preparation is crucial to avoid delays and ensure accurate data is available for discussion.

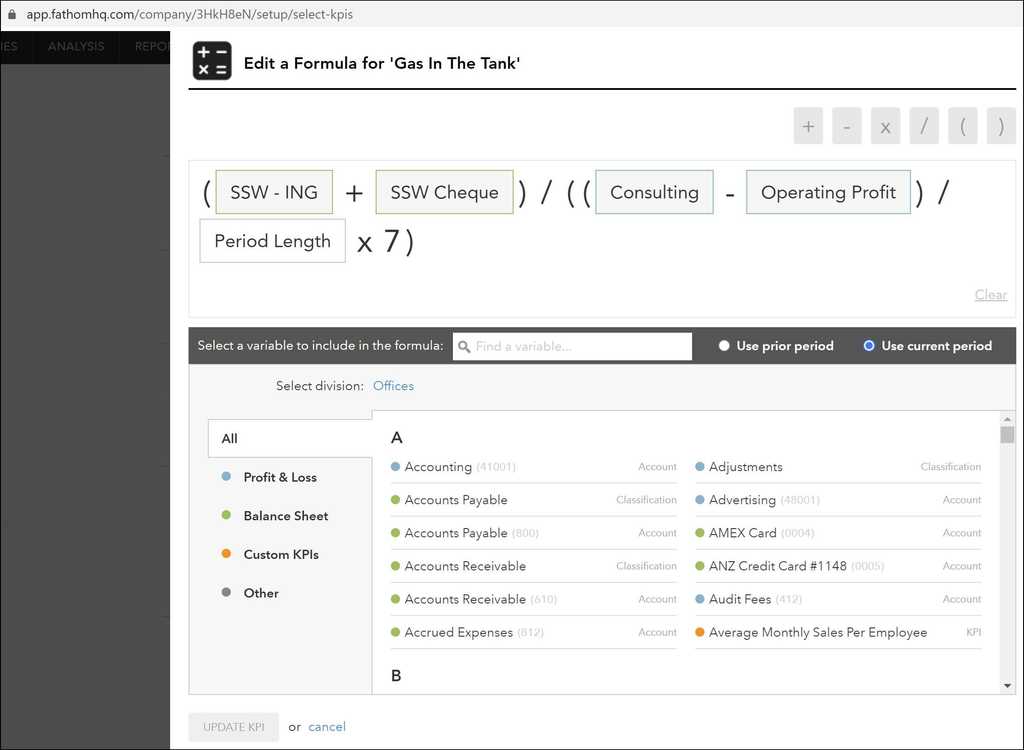

Note: SSW uses Fathom and Power BI to generate detailed financial and operational reports.

1. Reconciling

- Reconcile transactions in the accounting systems

- Balance Sheet reconciliation - emphasis on accruals, prepayments, loans

- Allocation of costs to appropriate cost centers

2. Data validation

- Fix any data discrepancies between systems

- Review of invoicing

3. Generate reports

- Executive page (summary KPIs)

- Current cash position

- Monthly Profit and Loss Report

- Year-to-Date (YTD) Profit and Loss Report

- Monthly Receipts Report

- Sales and Invoicing Report

- Utilization and Breakeven Analysis Report

- Cash Flow Report

- KPI selection

- Expenses Breakdown and Revenue Breakdown by Office

- Balance Sheet Summary Report

Meeting #1: Sales and operational performance (Sales Team)

This meeting focuses on operational and sales metrics to gauge the company's performance over the past month.

Agenda

- Review sales reports - Identify trends and performance gaps

- Analyze billable leaderboard - Highlight top-performing staff or projects

- Discuss utilization rates - Evaluate efficiency and productivity metrics

Tip: Record a concise summary of Meeting #1 to share with participants in Meeting #2 for an executive overview.

Meeting #2: Financial review and strategic planning (Accounting Team)

This meeting focuses on financial health and longer-term trends. Use visuals like graphs to simplify complex data.

Agenda

- Cash position - Review current and historical cash flow

- Revenue by client - Identify high-performing and underperforming clients

- Invoices and receipts - Assess monthly figures for accuracy

-

Profit and loss analysis

- Monthly profit (with graph)

- Monthly expenses

- Year-on-year trends

- Profit contribution % trends

- Profit and Loss Return % trends

By adhering to this structure and leveraging the tips provided, your monthly financial meetings will deliver actionable insights and drive better decision-making for your company.

A compliance sheet is a detailed document or tool used by companies to track and manage their compliance obligations. This sheet includes a list of all important lodgements, payments, and other regulatory requirements that need to be fulfilled by specific deadlines.

By systematically recording these obligations, the compliance sheet helps businesses ensure they meet all their legal and financial responsibilities in a timely manner.

The compliance sheet typically includes:

- Deadlines: Specific dates for when each obligation is due

- Descriptions: Brief descriptions of the obligations (e.g. tax lodgements, payroll taxes, and other regulatory filings)

- Responsible Parties: Names or roles of individuals responsible for ensuring each task is completed

- Status Updates: Current status of each obligation (e.g. pending, completed, overdue)

- Reminders: Alerts or reminders for upcoming due dates

Figure: Compliance Sheet helps company meet their responsibilities in a timely manner ❌ What if you miss important due dates

When a company forgets or overlooks important due dates for tax lodgements, payroll taxes, and other critical financial obligations, it can lead to a multitude of issues that adversely affect the business, such as:financial penalties, legal repercussions, cash flow disruptions, reputational damage, operational interruptions, etc.

Understanding these potential problems highlights the necessity of maintaining a detailed compliance sheet.

Figure: Fail to meet the compliance requirements ✅ Why you need a Compliance Sheet

Implementing a Company Compliance Sheet can significantly mitigate the risks associated with missing important due dates. Here are several reasons why a compliance sheet is crucial for any business:

- Ensures Timely Compliance: A compliance sheet tracks all important due dates and deadlines, providing reminders and alerts for upcoming submissions

- Financial Management: By avoiding unnecessary financial penalties and interest charges, a compliance sheet supports accurate budgeting and cash flow management

- Legal Compliance: A compliance sheet ensures adherence to legal and regulatory requirements, reducing the risk of legal actions and audits

- Operational Efficiency: Streamlining the compliance process reduces the administrative burden on employees, improving overall organizational efficiency and productivity

- Reputation and Credibility: Building trust with stakeholders, clients, and partners is essential for business growth

- Risk Management: Identifying and mitigating compliance-related risks is crucial for strategic decision-making

Implementing a Company Compliance Sheet ensures your business remains compliant with all regulatory requirements, maintains financial stability, and upholds its reputation.

By tracking and managing all lodgements and payments, your company can focus on growth and success without the worry of compliance-related issues.

“Co-pilot” rule

There is an SSW Rule called Do you use 'Checked by xxx'?, which encourages people to check each other’s works for better quality. When it comes to accounting, there is something more important than a 'Checked By'.

Accounting data is highly aggregated and there is only one source of truth. When the team is working together to contribute to the accounting system, it is more important to make sure that any changes are well informed within the team and the data contributed is accurate and free from errors.

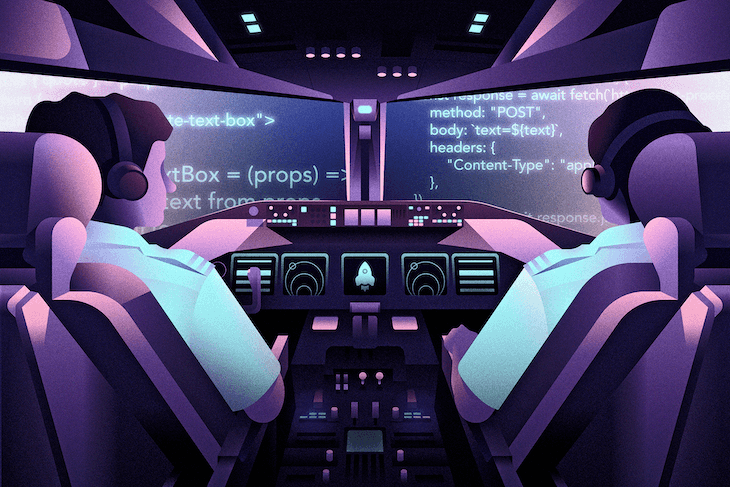

Systems generate bugs, and humans can make mistakes. An error-free system does not exist. When accountants work together, it sometimes feels like two pilots operating the same plane. The captain and co-pilot keep notifying and monitoring each other’s activities.

Figure: Captain and the co-pilot work closely and information are well informed and monitored between each other A small error can cause fatal crash, that is why every major and essential system will have one or more backup systems in case the primary system fails. A small error may not bring the business down, however it is important for accountants to have cross-checks to minimize human error during their daily work. When two people independently verify each other's work, it reduces the chance of errors. Cross-checking also promotes accountability and a sense of shared responsibility for the quality of the work being performed.

Avoid conflict of interests

A football player should not take on the role of the referee. The issue here is not with trust, but rather with ensuring that you have good systems that minimize risks.

When an accountant applies for a leave request, a reimbursement, a salary sacrifice or has a pay rise (congratulations), the best option is always to have another accountant make those changes. The best practice always involves at least 2 individuals – 1 person requesting the change and a 2nd person processing the change.

Reconciliation is the process of comparing and aligning financial records with external or internal data to ensure they are accurate and consistent. It is essential to maintain financial accuracy, detect errors, prevent fraud, comply with regulations, and build trust with shareholders and stakeholders.

Reconciliation is a good practice and critical process in accounting because it helps ensure the accuracy and integrity of financial data and financial statements.

Here's why reconciliation is important from the perspectives of both shareholders and accountants:

- Accuracy and integrity - Reconciliation ensures that financial records are accurate and consistent, which is fundamental to the integrity of financial reporting. Accountants have a professional responsibility to provide shareholders with reliable and truthful financial information.

- Fraud prevention - Reconciliation can uncover irregularities or discrepancies that might indicate fraud or financial mismanagement. Detecting such issues early allows accountants to take corrective actions and prevent financial fraud.

- Error identification - Errors can occur in the accounting process, such as data entry mistakes or calculation errors. Reconciliation helps accountants identify and rectify these errors, preventing them from affecting the accuracy of financial statements.

- Audit preparedness - Reconciliation prepares a company for external audits by ensuring that financial data and records are well-documented and accurate. Auditors rely on reconciliation as a tool to assess the validity of financial statements.

- Financial decision-making - Accountants use reconciled data to provide financial insights and analysis, which helps company management make informed decisions about budgeting, investment, and resource allocation.

Reconciliation safeguards the accuracy and reliability of financial data.

For shareholders, it instils trust, enables better decision-making, and ensures regulatory compliance.

For accountants, it helps maintain professional standards, prevent fraud, and provide accurate financial information for decision-makers.

In the course of business, you may occasionally provide some services or products to selected customers free of charge or at a discount rate. Often, because you're waiving one rule (the "please pay me" one!), people assume all other rules of service are waived - you should avoid that assumption!

Freebies/discounts need just as strict controls as regular projects

When you are giving something away at a discount or for free you are expecting a loss compared with a regular client. If you fail to follow regular processes not only will you incur an even greater loss you provide a lesser standard of service and put greater risk on the success of the project.A discount or freebie should follow all the standard processes such as:

- Initial meetings

- Written contracts

- Specification reviews

- Release plans

- Triaging additional items

- Release debriefs

- Issue a Discount Code for a free ticket to our regular events

Consider the follow scenario:

You have a concreter buddy who offers to do your driveway for mate's rates. He won't accept full price (because you're friends) and he thinks he's doing you a favour. The problem is, he won't commit to a timeframe because he has customers that ARE paying full price. You're quite happy to pay full price, because you know he does great work and you want to support his business. In the end, no one is happy. You have an extended wait to get the job done for a discount you don't want and he feels pressured to do extra work in his spare time.

A better approach is for the concreter to offer the discount AND book you in as a normal customer. He can give dedicated time and professional service and you get the job done with minimal delay. You can also provide excellent feedback and suggestions on the service he delivers, being both a friend and a customer. It is a much better outcome.

Feedback on events, products, or services

Often the people you choose to provide a freebie are the best people to provide feedback on your product or services. When you waive all your standard processes, they have no opportunity to review how you conduct your business.

So if you're offering a freebie (or any discount), you should ensure every normal standard of business is followed (including sending $0 invoices!) and make sure you get valuable feedback to help you run your company better.

To: Bob Cc: Adam Subject: Glad to have you + feedback Hi Bob

Sure we would love to have you at our event for no charge. You may register just like a real client.

You will receive an invoice with the items on it at $0.

It would be great if you could give us feedback on anything that could improve the experience (just as if you were a normal client).

Regards, Adam

Figure: Good example - Asking for feedback

Zero the invoices

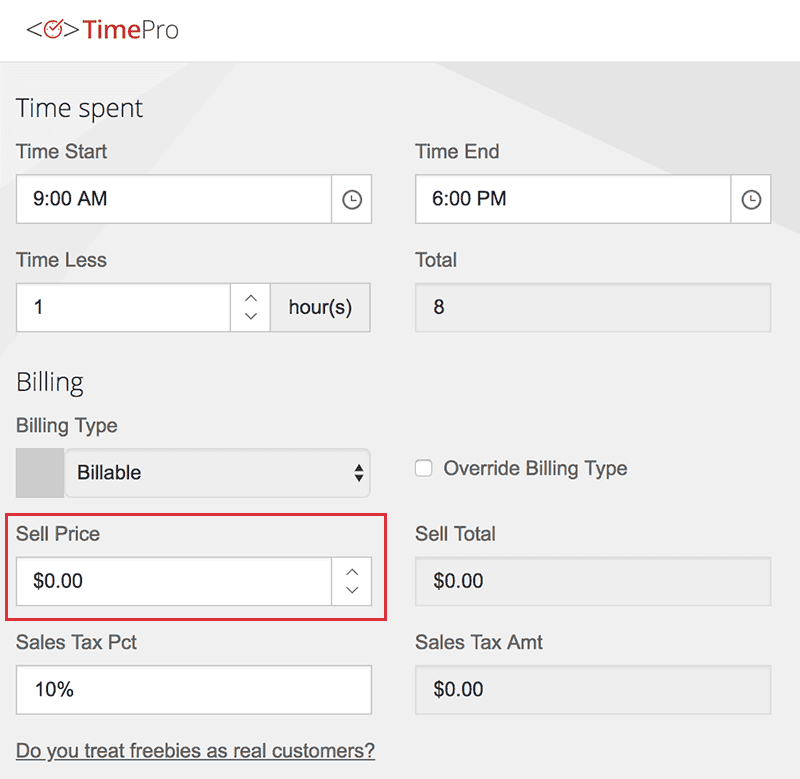

When entering timesheets for free work, set your rate to $0.

Xero is a great Accounting Software for all small businesses and especially for managing payroll.

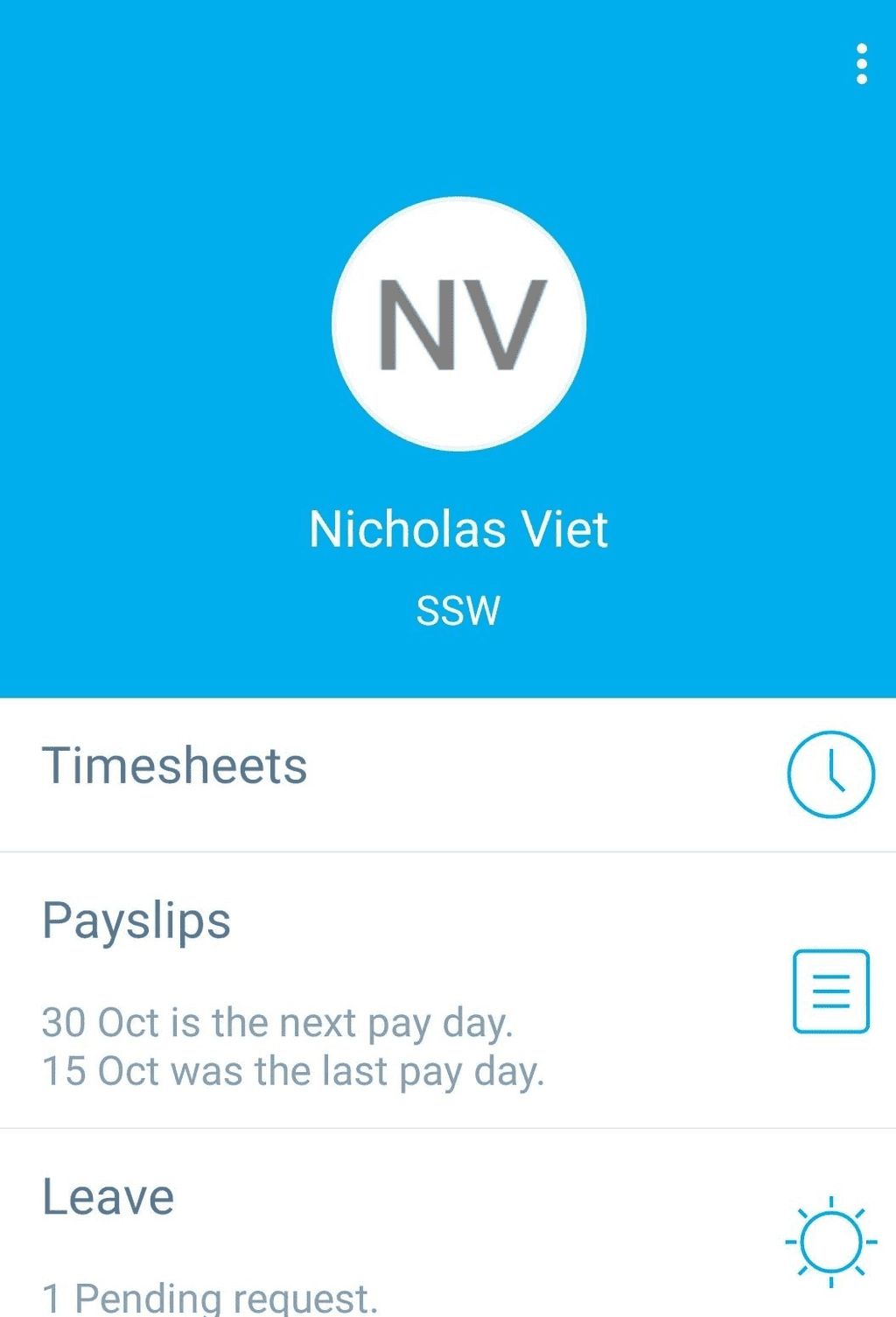

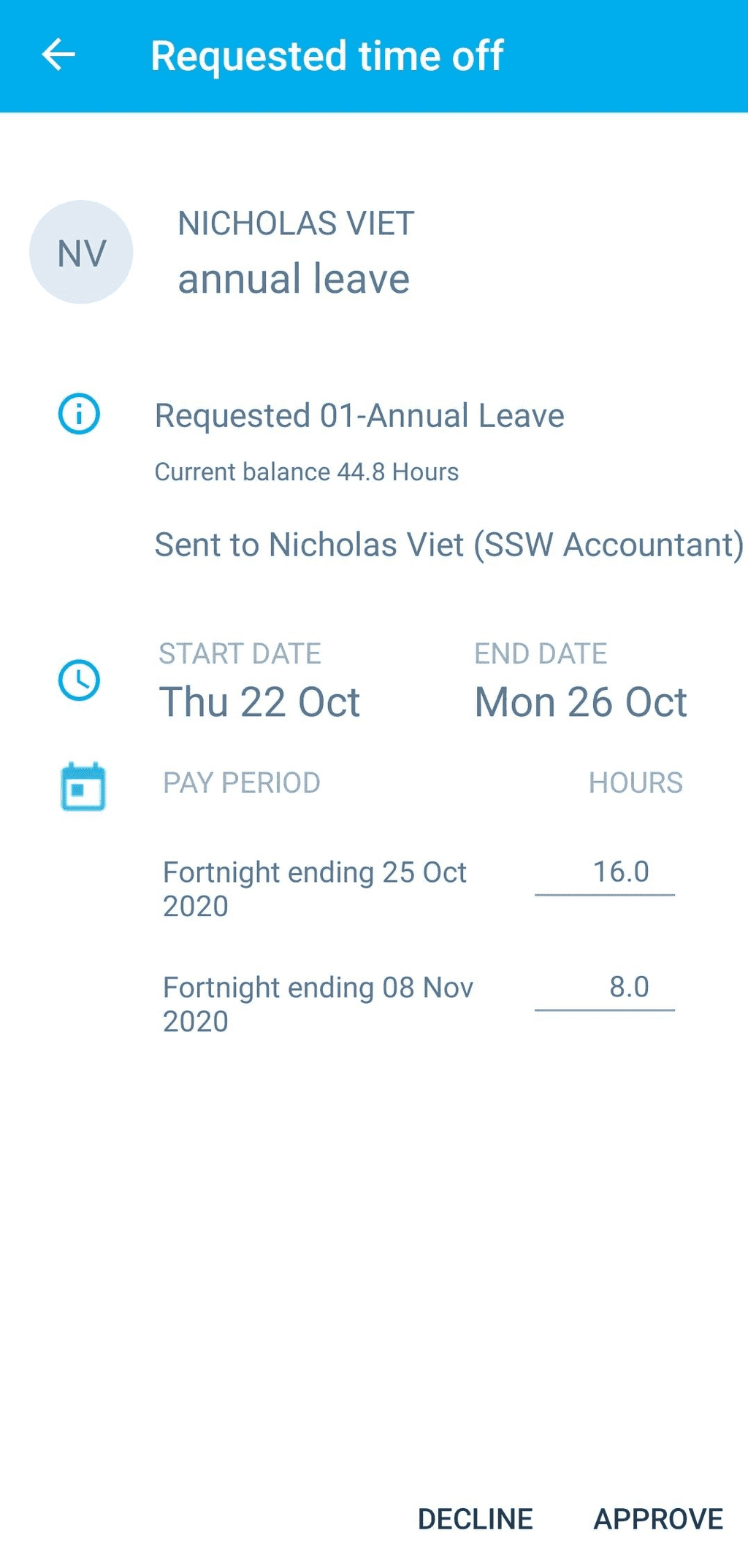

Xero Payroll allows for the employee to access their payroll details on web. These details include payslips, leave entitlements, requesting leave, personal information and bank accounts. It is a useful tool and many employees would benefit for long term planning with this kind of access, as well as saving countless hours of admin and back and forth emails for the payroll officer.

Xero has released a mobile app version of Xero Payroll called "Xero Me" which has a majority of the same function as the web version. Similarly, employees would be able to access their usual information as per the web version except for salary and bank account.

Figure: Xero Me app available on iOS and Android As such, the app makes for a great handy tool for employees to check their information, submit timesheets and request leave on the go.

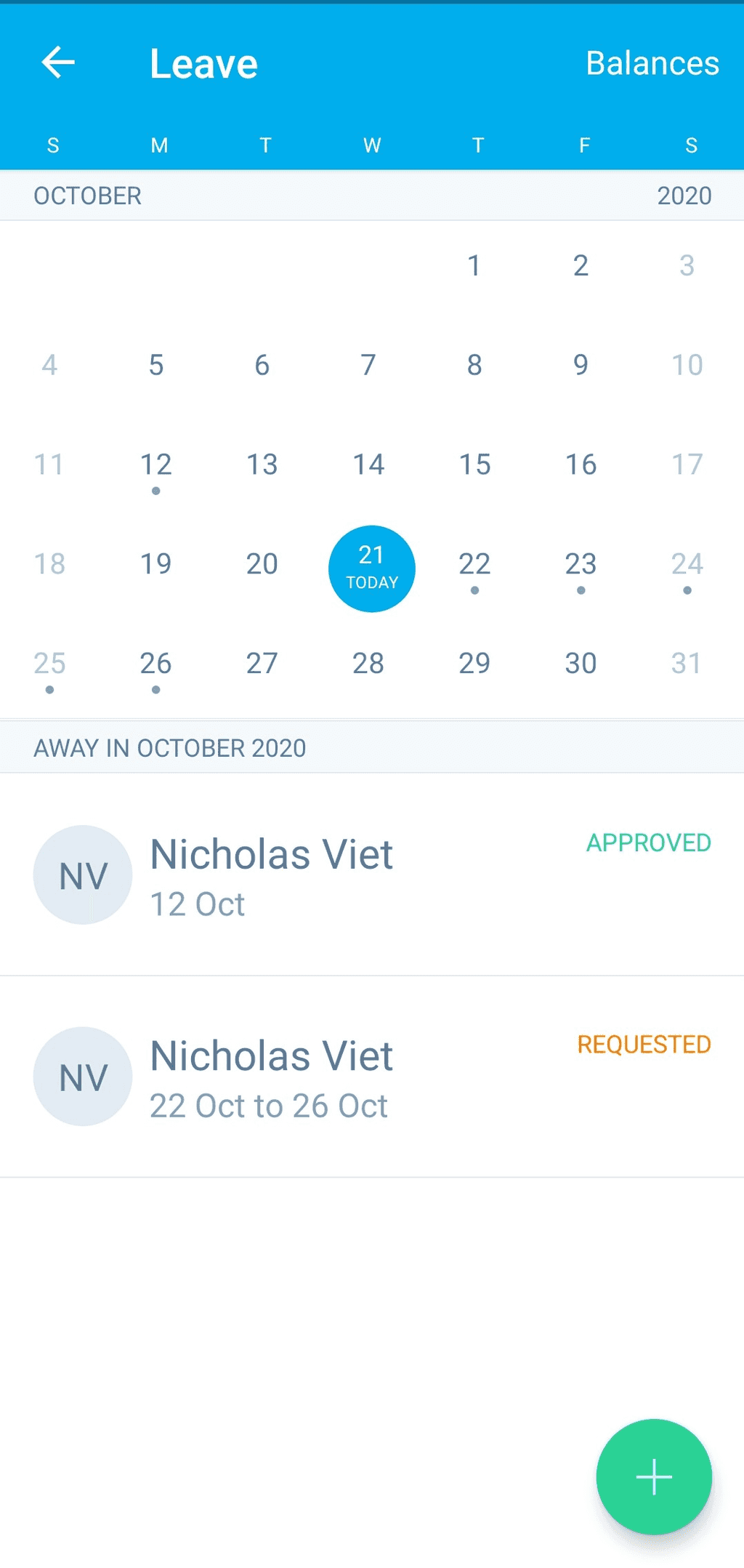

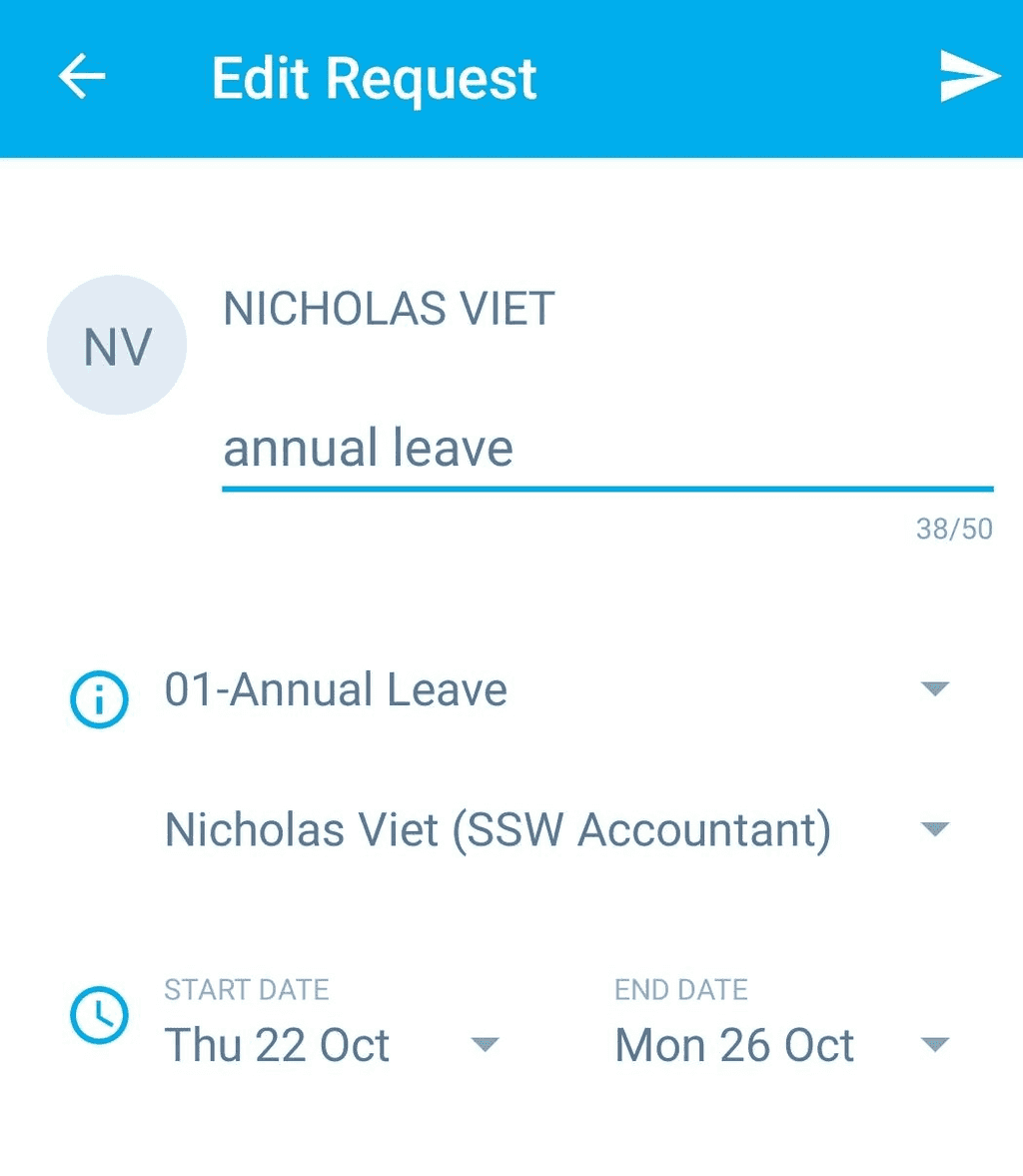

Requesting leave is simple with the app and can be approved just as quickly by the relevant approver with all systems updated simultaneously.

Simply click the plus symbol to add a new leave request and put in the basic information (type of leave, approver, days or hours taken and description). The approver will then get a notification and can easily approve or reject the request.

The app is free and as versatile as the web version with an added function of convenience. We highly recommend the use of a Xero mobile app to manage your personal payroll.

Long Service Leave (LSL) is an essential benefit for employees, recognizing their dedication and long-term commitment to a company. Many accounting solutions do not automatically calculate LSL provisions. This lack of automation can lead to transparency issues, as employees may find it difficult to track their LSL balances. Furthermore, the legislation governing LSL varies significantly across regions, adding an extra layer of complexity. For instance, the provisions in Victoria differ from those in New South Wales, necessitating a tailored approach for businesses operating in multiple states.

Adhering to Varied Legislation

The Challenge: The rules surrounding LSL are not uniform across all states and territories in Australia, making compliance a tricky affair for businesses operating in multiple locations.

Solution: To navigate this complexity, businesses must:

- Stay informed: Keep abreast of the LSL legislation in each state or territory where the company operates

- Tailor payslip information: Customize the payslip information to reflect the specific LSL provisions applicable to each employee, based on their work location

Visibility of Long Service Leave

The Challenge: Employees deserve and need clear visibility of their LSL accruals to plan their future and feel secure in their employment benefits. The absence of this information can lead to confusion and dissatisfaction.

Solution: Even if your accounting solution doesn't automatically calculate LSL, businesses must find a workaround to ensure this information is transparent and accessible to all employees. This might involve:

- Manual calculations: Regularly update LSL accruals and ensure they are clearly stated on employee payslips

- Use of supplementary tools: Consider leveraging third-party solutions to manage LSL calculations and display them on payslips

Figure: Bad example - Employees have to ask HR for their LSL balance, leading to a backlog of inquiries Ensuring employees have visibility of their LSL balances is not just about compliance; it's about valuing your workforce and their contribution to your company. Despite the technical limitations of some accounting tools, with a proactive and informed approach, businesses can provide their employees with the transparency they deserve and ensure compliance across different legislative landscapes.

Are you planning to buy a cool laptop to boost your productivity? You can place your order from Apple or JB HiFi at full price. Or if your employer offers the ability to Salary Sacrifice, you can spend less by paying with your pre-tax money (rather than after-tax).

Video: Pay Less Tax with Salary Sacrificing! | Electronic Devices (4 min)What is salary sacrificing for electronic devices

In Australia, salary sacrificing is when your employer agrees to pay for your device(s) with your pre-tax salary, therefore you pay less tax.

Most companies will let you salary sacrifice FBT-exempted (Fringe benefit tax) portable electronic devices that:

- Are used predominantly for work-related purposes

- Are easily portable and designed for use away from an office environment

- Are small and light

- Can operate without an external power supply

- Are designed as a complete unit

This provides you with a wide variety of work-related devices that you could salary sacrifice and save money on. Some devices such as laptops, tablets, phones, and headphones are just some of the examples.

Accessories (such as cases and chargers) can be included in a salary sacrifice arrangement only if they are necessary for the basic operation of the electronic device. Accessories bundled into the price by the retailer can be included in the arrangement.

The benefits of salary sacrifice

Salary sacrificing has many awesome benefits:

✅ You pay for your devices in pre-tax dollars (a saving of approximately 30% depending on your tax bracket)

✅ You don’t pay GST (saving you another 10%)

✅ Less admin - Nothing for you to do at tax time

✅ You get to choose your device - and you own it

✅ You can get something with more powerful than you could have without the savings

Tip: As an added benefit, both you and your company can coordinate to incorporate some branding into the asset through salary sacrifice.

Scenario

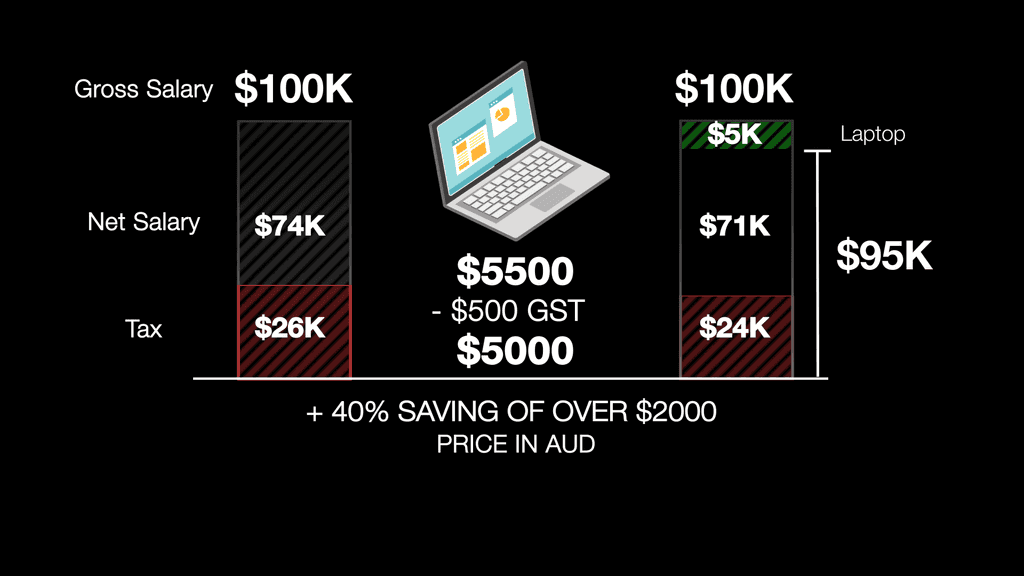

Bob is earning $111k per annum (salary package inclusive of $11k Super). He wants to buy a $5,500 laptop.

Let's look at how he saves $2,500 on the new laptop.

Figure: Without Salary Sacrificing vs Salary Sacrificing ❌ Without Salary Sacrificing ✅ With Salary Sacrificing Salary package inclusive of Super $ 111k $ 111k Less Super $ 11k $ 11k Pre-tax deduction $ 0 $ 5k Gross Income $ 100k $ 95k Less Tax $ 26k $ 24k 💻 Purchase $ 5k $ 0 💻 GST on Purchase $ 0.5k $ 0 Take-home pay $ 68.5k $ 71k Figure: Bob saved $2,500 on take-home pay with salary sacrificing

Salary sacrifice is an effective way to reduce your taxable income, allowing you to increase your take-home pay. It’s a financial arrangement where part of your pre-tax salary goes towards an approved expense, whether it’s a laptop, additional superannuation contributions, or even a car!

When it comes to cars, this arrangement is known as a novated lease — a car financing option that lets employees treat their personal car as if it were a company car. It's a 3-way agreement between the employee, their employer, and the novated lease provider.

As one of the most cost-effective car ownership options for Australians, a novated lease offers access to income tax and GST savings, additional fleet discounts, and the convenience of having a fully maintained car through the lease provider.

Under this arrangement, the employer deducts lease payments and car-related costs directly from the employee's pre-tax salary. The lease provider manages vehicle expenses, including finance, insurance, registration, maintenance, and fuel, which are bundled into the monthly payment.

Each pay period, the employer deducts the lease payments before tax, transferring these funds to the lease provider. This setup provides the employee with tax benefits and streamlines car ownership by combining all vehicle expenses into one, pre-tax payment.

Figure: How novated lease saves money for you If the employee leaves the company, they take the lease with them, allowing for flexibility in continuing payments under a new employer or privately.

Most people show little interest in their superannuation because it feels so distant in the future. That is a mistake!

Superannuation is more than just a retirement savings account - it's a long-term investment that benefits greatly from the power of compound interest, strategic salary sacrifice, and good fund management. Use these tools and strategies to maximize your financial future!

Video: How to maximize your Superannuation | Stephan Fako (5 min)

Let’s break it down by exploring 3 key aspects you need to understand:

- How compounding and interest rates affect your investment return

- How to grow Super through salary sacrifice (going beyond the mandatory 11.5% in 2025 and 12% in 2026)

- How to check your Super fund is giving you strong returns

What is Superannuation?

Superannuation (Super) is a compulsory retirement savings system in Australia. Your employer makes contributions on your behalf, which are invested and managed by your chosen Super fund until retirement.

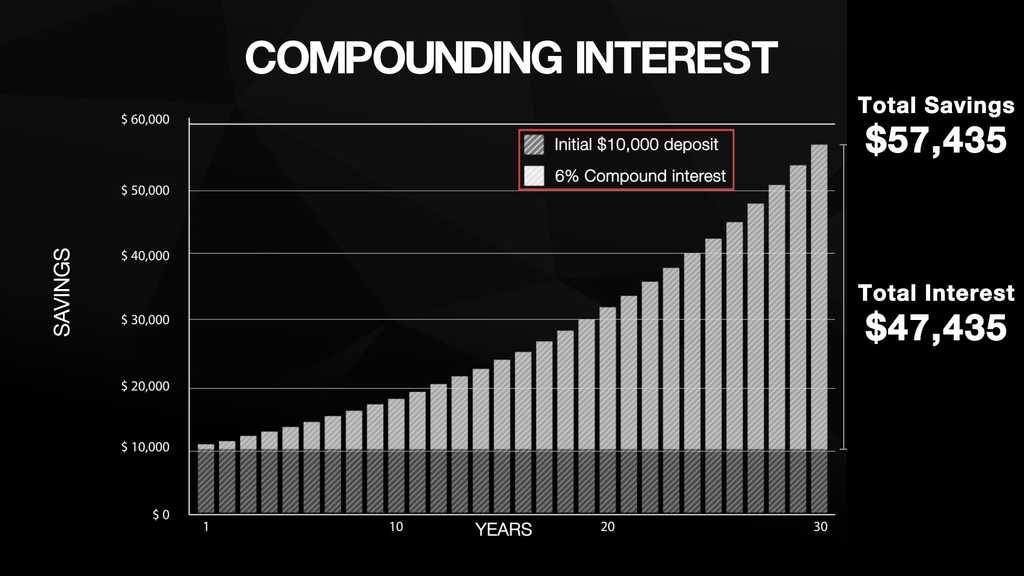

1. The power of compound interest

You may have heard people say that the sooner you start saving, the better off you'll be. That’s because of compound interest.

Compound interest occurs when your initial investment earns interest, and then that interest also earns interest. Over time, this snowball effect can significantly increase your returns. Since Superannuation is a long-term investment, the impact of compound interest can multiply your funds over decades.

If you would like to find out more on the types of interest, check out Investopedia’s website.

Figure: Investment returns compounding annually at 6% for 30 years (that’s without contributing any more $) How even a small return rate difference (say 1%) impacts you

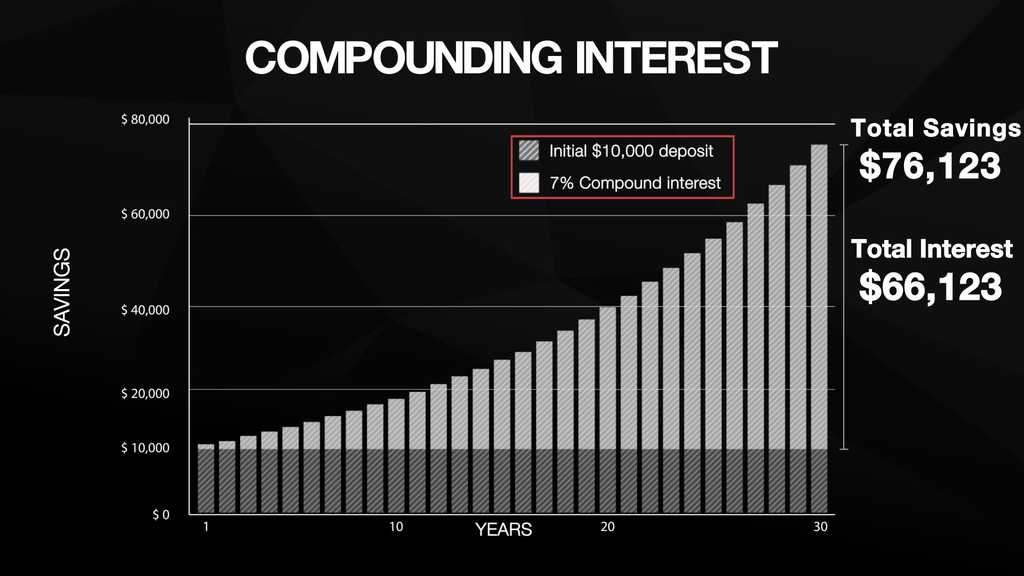

Investment return (interest) rates play a significant role in driving the growth of your Superannuation balance over time. Even small differences in rates can have a significant impact on your retirement savings over a decade, so understanding how return rates affect your Super is crucial.

When investment returns are higher, your Super fund’s investments generate more returns. Compounding these returns over a decade leads to substantial growth in your Super balance.

Conversely, a lower return rate reduces the speed at which your Super balance grows. Although your investment still benefits from compounding, the overall growth is more modest compared to higher rates.

Figure: It looks the same but increasing the investment return rate from 6% to 7% over 30 years will increase your ending balance for almost $20k (a slightly better fund, can give you higher returns) 2. Increasing Super balance through salary sacrifice

Another great way to boost your Super balance is to go beyond the mandatory 11.5% (FY 2025) contribution (aka Super Salary Sacrifice). This strategy allows you to contribute additional funds to your Super from your pre-tax salary.

Super Salary Sacrifice offers 2 key benefits:

✅ Tax Savings - Your salary sacrifice contributions are taxed at 15%, which is much lower than the top tax rate of 45% (that is 30% lower than your marginal income tax rate)

✅ Super Boost - Extra contributions into Super lead to faster compounding growth

Warning: The important thing to remember with Super is that your contributions are subject to the Superannuation Contributions Cap. The Cap is $30,000 per year in FY2025, but it changes over time. It’s essential to check the current Cap each year.

Figure: Salary Sacrificing $50 per week, with a 7% investment return over 30 years will increase your compounded interest by almost $170k 3. How to choose the right Super investment option

Understanding the impact of compounding and return rates helps you compare your Super fund returns to a benchmark or assess alternate investment options.

Super funds typically offer a variety of investment choices, each with different levels of risk and return. The level of risk you're comfortable with depends on your risk tolerance - your ability and willingness to take on risk in exchange for potential rewards.

When selecting an investment option, it’s important to align your choice with both your risk tolerance and the time left until retirement. Here’s a breakdown of the most common investment options offered by Super funds:

- Conservative - Lower risk, lower potential returns. These investments focus on stable assets like cash and bonds

- Balanced - A mix of growth and conservative investments. Suitable for those with moderate risk tolerance

- Growth/Aggressive - Higher risk, higher potential returns. These options invest more heavily in shares and property

- Socially Aware - Varies in risk and returns. Focuses on ethical and sustainable investments. Best for those wanting to align investments with their values

- Direct Investment - Customizable risk and returns. You choose individual shares, ETFs, and term deposits. Best for experienced investors wanting control over their portfolio

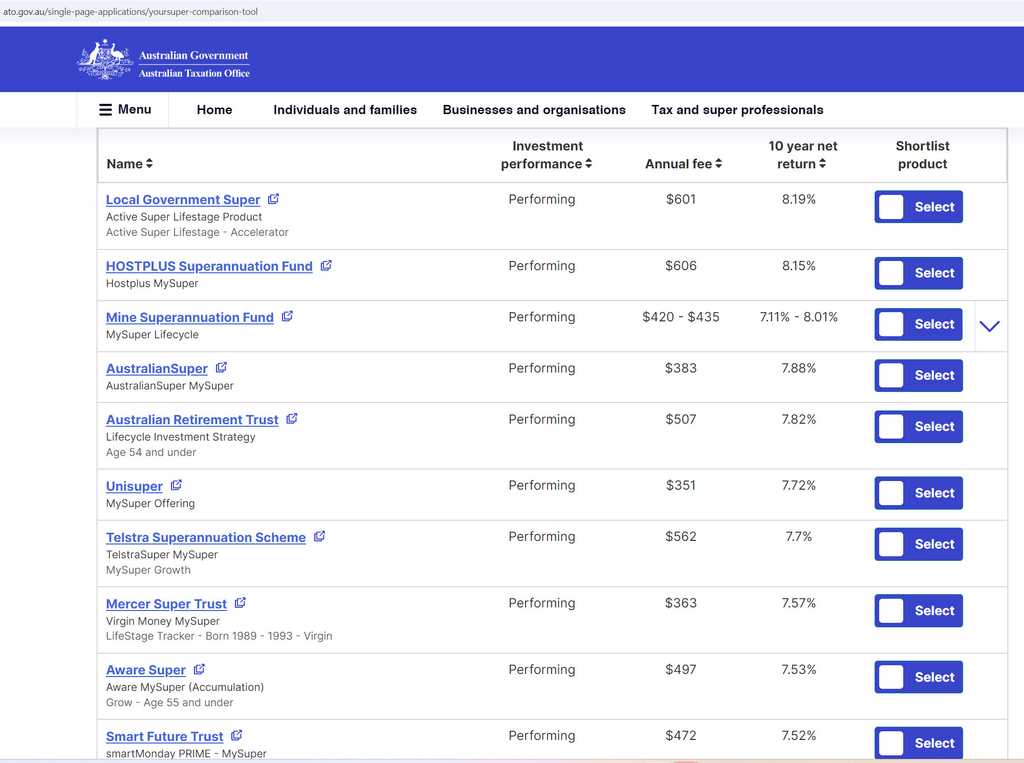

Finding the best Super fund for you

Choosing the right Super fund can make a big difference in your retirement balance. Before making any decisions, consider fees, investment options, and investment performance, etc.

Use the ATO's Super Comparison Tool to compare Super funds and find one that suits your needs.

Warning: Performances change so look at it once a year.

Figure: Look at the best performing non-excluded Super funds How to rollover into a different Super fund

Rolling over your Superannuation to a different fund can be a smart move, especially if you're looking for lower fees or better performance. The process is relatively simple, and here's how:

1. Compare Super Funds

Before rolling over your Super, it's important to compare different Super funds to ensure you’re choosing the one that best fits your needs. Look for:

- Fees - Lower fees mean more money stays in your Super

- Performance - Check past performance, but remember, it doesn’t guarantee future results

- Investment options - Make sure the fund offers investment choices that align with your risk tolerance and goals

Tip: You can use the ATO Super Comparison Tool (previously mentioned) to help compare funds.

2. Check for exit fees and insurance

Some Super funds may charge exit fees, although many have been phased out. Additionally, check if you have any insurance attached to your existing fund, as this may not automatically transfer. Ensure your new fund offers adequate insurance coverage if needed.

3. Rollover

Once you’ve chosen a new fund, follow these steps to roll over your Super:

- Log in to MyGov - If you have a MyGov account linked to the ATO, you can initiate the rollover online

- Complete a Rollover Form - Alternatively, you can fill out a form provided by your new Super fund. They may also offer an online service to handle the rollover on your behalf

- Email your employer - With your new fund details and membership number

Bonus: Using Super to buy your first home (Salary Sacrificed amount)

A cool thing to consider if you have never owned a property in Australia. The First Home Super Saver Scheme (FHSSS) allows eligible first-time home buyers to access their salary sacrificed Super contributions to help purchase a home. Here’s how it works (in FY25):

- Eligibility - You must be a first-time home buyer and meet the FHSSS requirements

- Salary Sacrifice contributions - You can access up to $15,000 of salary sacrificed Super contributions per year, and a maximum of $50,000 in total

- Tax benefits - Contributions are taxed at 15%, often lower than your regular income tax rate, helping you save faster

- Withdrawal process - You can apply to release these funds through the ATO when you're ready to buy your home

- Timing - You must sign a contract to buy or build within 12 months of requesting the release

This strategy can help you save for a deposit faster, while still benefiting from tax savings within Super.

Check out ATO’s website for further information on the First Home Super Saver Scheme.

Maximize your financial future

Remember, even small adjustments today can lead to big rewards down the road. Whether you’re comparing funds, adjusting your risk level, or considering salary sacrifice, each step brings you closer to a more comfortable retirement.

Before making decisions about your financial future, don’t forget to seek independent professional advice.

When discussing pay, ambiguity is a foe. Terms like 'salary' or 'pay' are too vague and can lead to misconceptions about what is included in an employee’s final payment.

🇦🇺 In Australia, there is a mix of terms used:

- Remuneration

- Total Remuneration Package (TRP)

- Remuneration Package

- Remuneration paid to an employee as a reward for their services

- Pay

- Pay Terms

- Payment Package

- Salary

- Salary Package

- Earnings

- Compensation

- Compensation Package

- Wage structure

- Salary Package Including Super (Recommended ✅)

The last option is the best because it prevents misunderstandings. The term makes it clear that the figure includes superannuation contribution, which is essential to avoid the unpleasant surprise of salary shock where employees may not realize that super is part of their total pay.

Figure: Bad example - Ambiguous phrase means confusion Figure: Good example - No confusion as to what the payment includes Whenever you are worried there might be confusion about a phrase, it’s always a good idea to clarify with the other person and you should put in writing what you agreed with the phrase 'as per your conversation'.

Payroll tax is a common wage-related expense that many businesses will have to account for in their month-to-month operations.The rules around when you begin paying for payroll tax and the amount you have to pay is dependent on your State Government's rules.

The Australian Government has general information about payroll tax, including affected businesses and possible exemptions. However, because the State Government laws take precedence, your business should take information from the State Government's website. For a general understanding of payroll tax, see the Australian Government's main website as follows:

It is important to stay up to date with the State Government's rules as they may change from time to time. The relevant State Government websites for NSW, QLD and VIC are as follows:

Tip: A common error businesses make is not realising the available exemptions for payroll tax. The most common exemption missed in calculating payroll tax is salary sacrificed items (excluding salary sacrificed superannuation). These items reduce the taxable wages. For example, the NSW State Government rule states payroll tax is applicable on the 'reduced wage that the employee pays income tax on'. You can refer to the relevant NSW page below.

Every state treats salary sacrifice differently for payroll tax purposes, so be sure to check your State Government's rules before processing your payroll tax return.

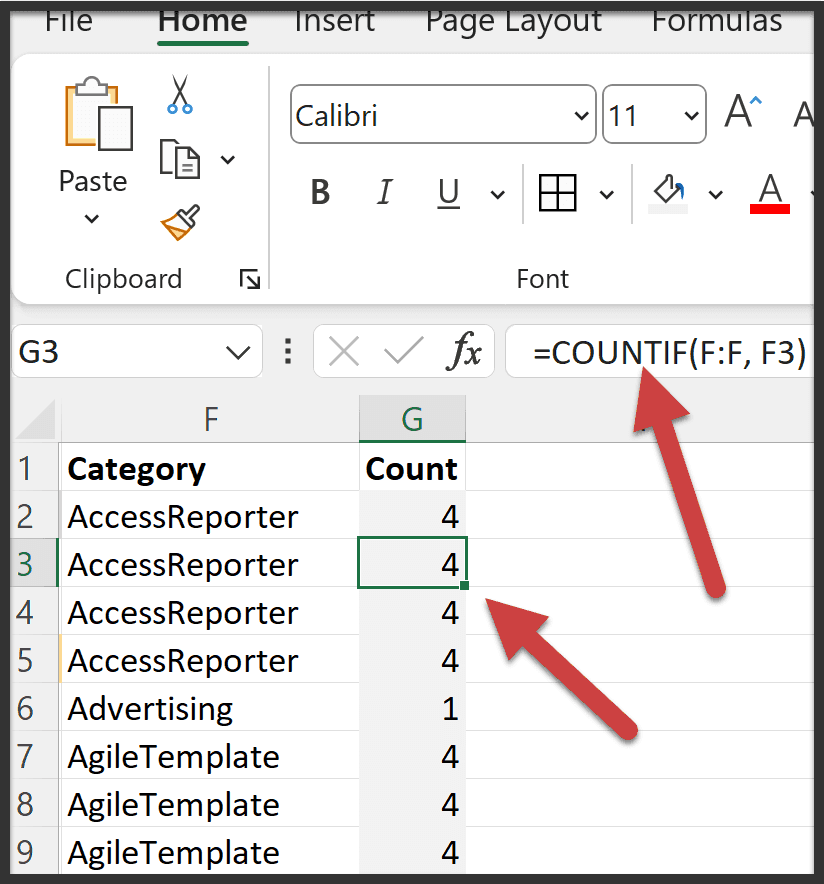

Applying a grey background to formula cells makes it easy to spot them at a glance, reducing the risk of errors and improving the overall organization of your spreadsheet. It helps you quickly distinguish between data and formulas, saving time and making your work more efficient.

Use visual cues to separate formulas from inputs

To make Excel spreadsheets clearer and more robust, it's best practice to apply a light grey background to all formula cells. This helps:

- Prevent accidental overwriting of formulas

- Make the structure of the spreadsheet easier to understand

- Save time for others (and your future self) when maintaining the file

How to apply the formatting

- Identify formula cells – Use

Go To Special(Ctrl + G → Special → Formulas). - Apply a light grey fill – Use a consistent and subtle fill color like

RGB(217, 217, 217)or use the built-in 20% - Accent1 gray theme in the fill color palette. - Lock the formula cells and protect the worksheet if you want to enforce this at a technical level (optional but recommended).

Bonus tip

Also consider using cell styles to standardize this across your organization. Create a custom style for "Formula Cell" with the grey fill, and train your team to use it.

This visual convention goes a long way in creating clean, maintainable, and user-friendly Excel sheets.

Encouraging professional development and recognizing achievements are crucial for fostering a positive workplace culture. SSW's Certification Reward system is a testament to this, offering additional leave to employees who complete Microsoft certifications. This initiative not only motivates employees to pursue further learning but also highlights the company's commitment to staying at the forefront of technology.

Understanding Certification Rewards

Certification Reward is a special category of leave granted to employees as a form of recognition for their effort and time invested in completing Microsoft certifications. Here's how it works:

- Award Criteria: Employees become eligible for a Certification Reward upon successfully completing a Microsoft certification

- Visibility and Tracking: A distinct leave category should be used within your accounting system specifically for Certification Reward

Not a Fairwork Mandate

It's important to note that the Certification Reward is not mandated by Fairwork. Instead, it's a proactive approach to incentivize its team members to engage in professional development, specifically around Microsoft technologies. This strategic focus not only enhances individual skill sets but also elevates the collective expertise within the company, ensuring you remain competitive and innovative in delivering solutions.

The Certification Reward system exemplifies how valuing and investing in employees' growth can create a dynamic and forward-thinking workplace culture. It's a clear win-win: employees expand their expertise, and strengthens your company's capability to deliver cutting-edge solutions.

We all know the situation but never think it will happen to us. Many businesses believe they are well prepared in the event of a disaster or a downturn in business activity.

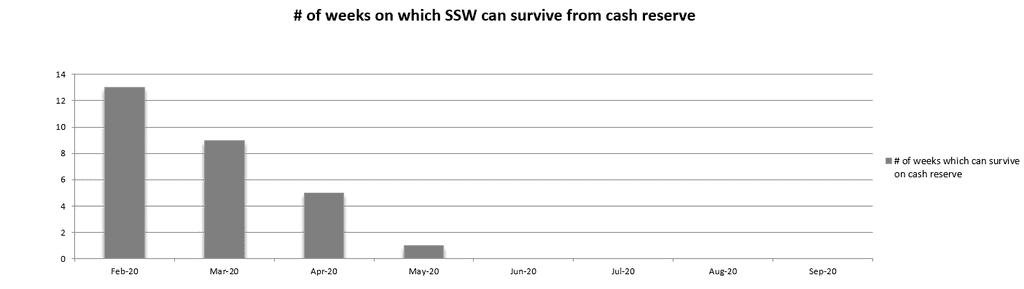

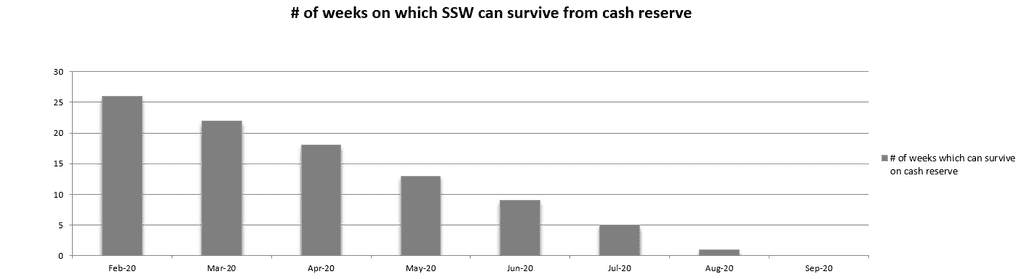

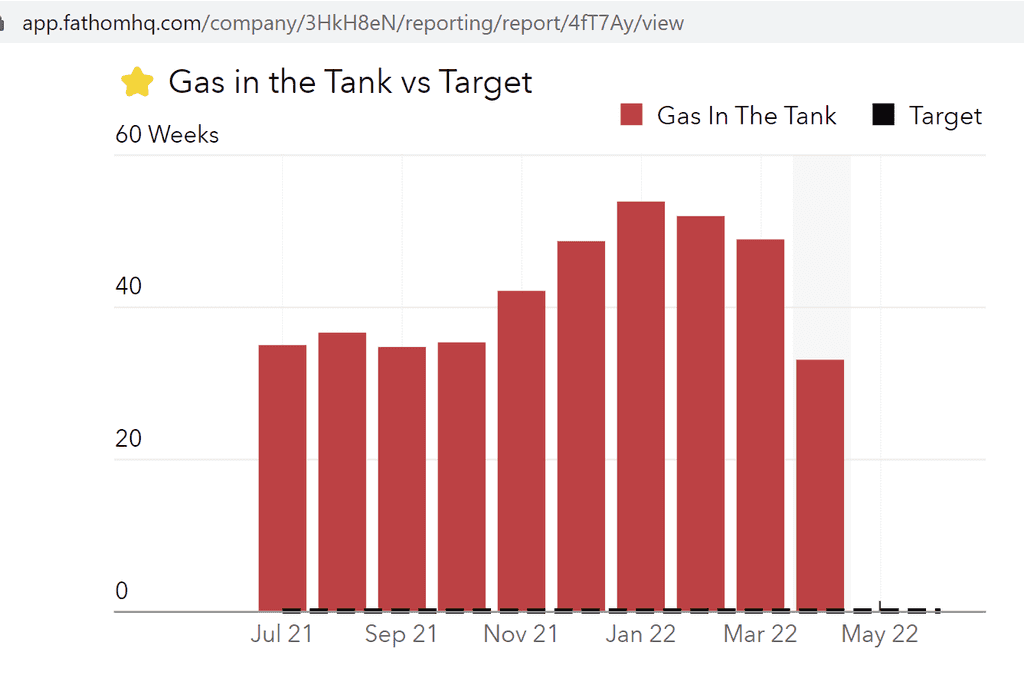

In the unfortunate event that all your customers suddenly stop trading (meaning your income levels are reduced to zero), do you know how long you can keep the business afloat based on your cash balance, without taking any cost-cutting measures?

It is recommended to keep track of your "Gas in the Tank" report at least every month to determine the number of weeks your business will remain afloat in the unlikely event of the above scenario.

For most businesses, a good amount of cash to hold should cover approximately 26 weeks of costs .

The length of time which the business can survive on cash reserves is not as high as ideal. 13 weeks is not a lot of time to respond to a significant downturn of activity, assuming it was identified at the first-week activity went down. This report would have revealed the calculations and henceforth increase the business awareness and to keep the foot on the pedal.

This example is a good indication the business has enough cash reserves, that even with a significant downturn in activities, there will be enough time to respond and likely reverse the situation. They achieve this by either maintaining cost measures low or consistently driving for new customers and a minimum level of business activity, as well as other business-specific strategies.

Often a business can become satisfied with a few good months of positive cash flow whether it be a result of cost-cutting efforts or improved business activities for those months.

As a result, some businesses become complacent and not realise their actual ability to stay afloat based on their cash reserves if disaster strikes.

Maintaining a Gas in the Tank report will provide a visual indication and a prompt to revisit costs and additional measures in driving business activities, before it becomes a problem.

It is essential to be familiar with your organization's Terms & Conditions, as it may impact the way you invoice.

SSW Terms & Conditions allow SSW to invoice on a Prepaid basis as per part '6 - Pre-Paid Work' & '19 - Payment Terms'.

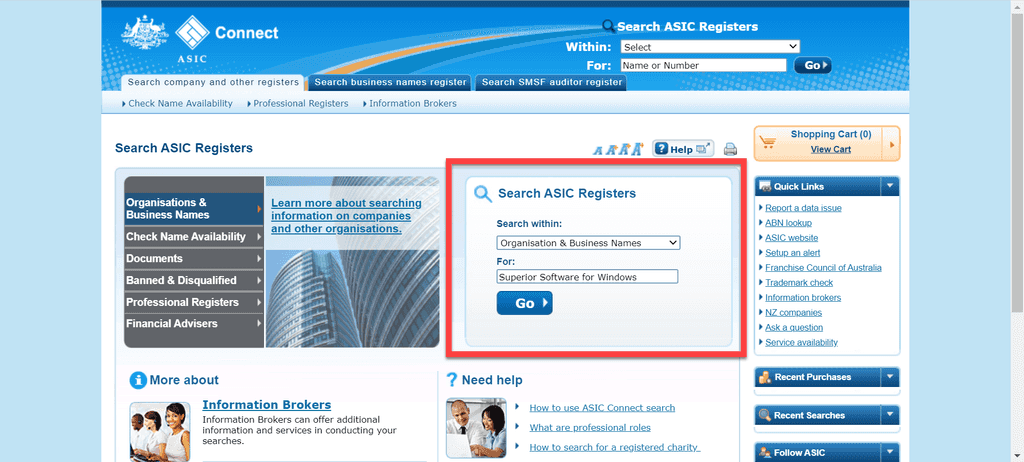

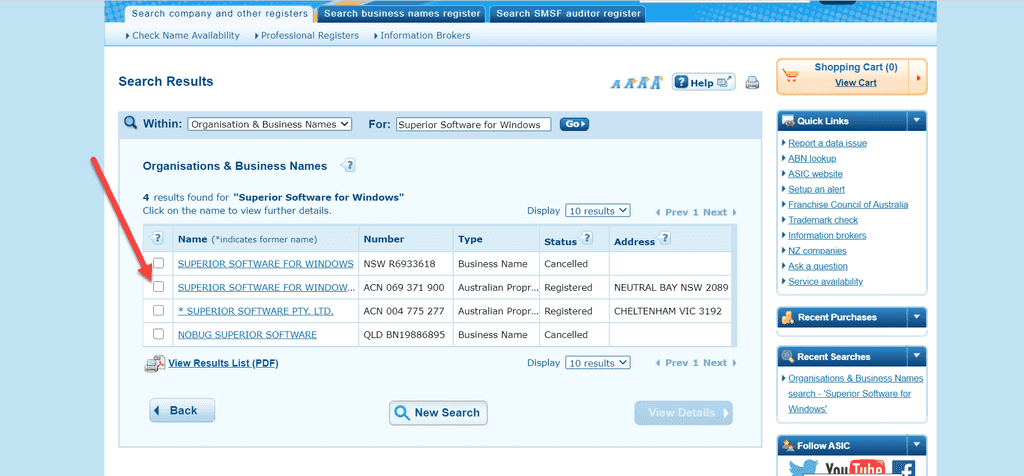

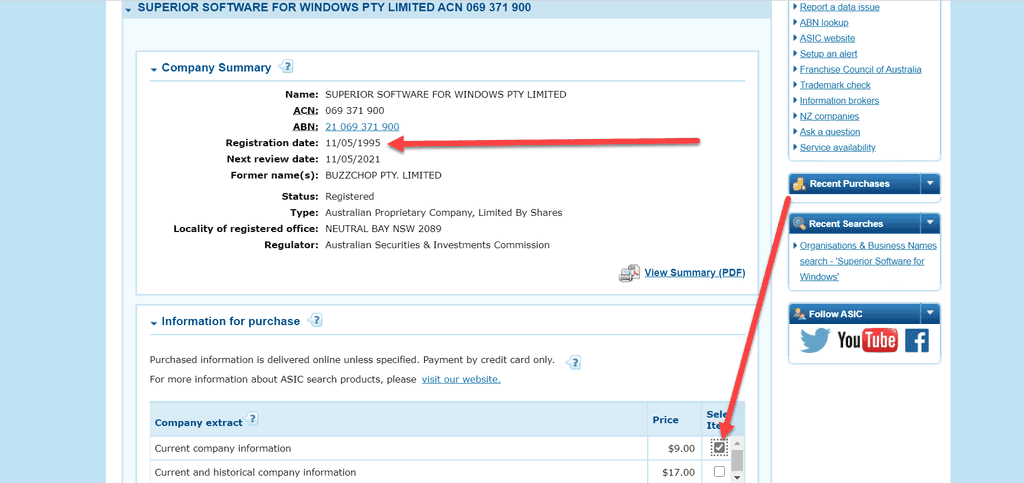

It is also highly recommended to invoice customers, who have been in existence for less than 2 years on a prepaid basis. It may, however, be an awkward conversation or irrelevant on the customer's behalf to ask of their organization's age in an initial meeting. Instead, you can perform an ASIC Company Search to determine the customer's organization age.

To do so, follow these steps:

- Navigate to ASIC Company search page above and change the filters to 'Organisation & Business Names'. Enter the customer's name or ABN number

- Select the appropriate company

- Review the registration date or alternatively, purchase a $9 company extract which provides the same details on the free page with some additional information (however irrelevant for prepaid purposes)

- Should the registration date be less than 2 years old, ensure that the message is pushed across to the state managers so they can push towards invoicing on a prepaid basis wherever possible.

If you negotiate with a supplier in relation to an invoice, do you ensure the invoice is reissued?

It is not always common but sometimes you will negotiate a change in the agreed price once an invoice has been issued by a supplier. This might be because there was a change or defect in the good or service provided and a lesser amount is agreed or an agreement that a certain amount of the invoice will be paid later when the rest of the product or service is delivered.

Do not pay an invoice in part. You should ask the supplier to reissue the invoice or issue a credit note in relation to an invoice. Otherwise, the supplier may say that there is a balance of the invoice owing.

“Jim. OK, I'll just pay $165, not the $220 on the invoice"

Figure: Bad example - Not paying the full amount of an invoice

“Dear Jim, please reissue the invoice or provide a credit note for the now agreed correct amount."

Figure: Good example - Requesting a new invoice that will be paid in full

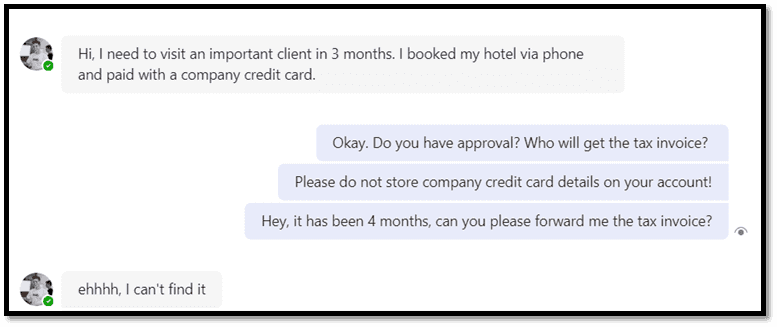

When employees need to travel between offices or various locations, they typically require accommodation, flights, transportation, and other necessities. Managing these bookings, obtaining approvals, and handling tax invoices can be both costly and time consuming.

Imagine first organizing a trip 6 months in advance, and having to wait that long until you receive the invoices. Now multiply this complexity by managing several reservations concurrently. It becomes overwhelming!

In a dynamic business environment, effectively managing travel expenses is key for organizations trying to optimize costs while maintaining efficiency and compliance.

Utilizing centralized booking platforms can help greatly in achieving this.

Example of centralized travel systems

- Accommodation – Trip.com

- Flight – Qantas Business, Virgin Business

- Uber – Uber for Business

It is important to establish appropriate access levels and securely share login credentials using tools like Keeper. This ensures that administrators and accountants can efficiently manage documentation and expenses.

Centralized travel management system offers several critical advantages for organizations:

- Streamlined Processes - Centralization simplifies travel expense procedures, reducing manual tasks and inefficiencies

- Control & Compliance - Ensures adherence to travel policies and regulations, minimizing risks and ensuring consistency

- Insightful Reporting - Real-time data provides visibility into travel spending, facilitating informed decision-making and budget planning

- Fraud Prevention - Automated validation checks and approval workflows help detect and prevent fraudulent expenses

- Cost Efficiency - Centralization reduces administrative overhead and unnecessary spending, leading to cost savings

- Scalability & Flexibility - Systems can adapt to changes in travel requirements and organizational growth, ensuring continued efficiency

You should be reimbursed for all reasonable expenses incurred in carrying out your duties, which are above your normal costs, to and from the office.

A common example is bus and train fares to client sites. In Australia, amounts under $100 could be reimbursed through Petty Cash but in China, it would be around ¥ 300.

Remember to treat your company's money like your own and minimize costs where possible. Try to search around for a better price before committing to a purchase.

All expense claims must:

- Be work-related

- Be made within a week

- Be signed by the claimant and authorized by the relevant Manager

- Be supported by Tax Invoices

- Not include alcohol, as it incurs FBT

- Receipts should be in English (where possible), or you must write on the receipt what the expense is, and what it was for

Tip: If necessary, you can use the Google Translate app to translate your receipts by taking a photo!

::: china🇨🇳 If you're in China, all-expense claims must:

- Be work-related

- Only Fapiao is available

- Be made within a month

- Be authorized by the relevant Manager :::

When you make purchases in-store by card, you typically receive 2 receipts: Tax Invoices and Eftpos Payment Receipts.They might seem like two peas in a pod, but they're different creatures serving different purposes.It is important to distinguish the difference between a Tax Invoice and Eftpos Payment Receipt—but let's be honest, the difference confuses most of us!

The primary purpose of a Tax Invoice is to provide a comprehensive record of a transaction for tax and accounting purposes.While an Eftpos Payment Receipt is like a digital high-five after you've paid for something using Eftpos. It's a record saying, "Yep, the payment went through!"

If you're not sure which papers you need, just keep everything. It's way better to have too many records than miss out on something important.

Tax Invoice

An official document issued by a seller to a buyer, detailing the products or services provided along with their respective prices.It is a legal requirement for businesses to issue tax invoices for taxable sales.A tax invoice would normally have the following:

Business Information

- Seller's info – Name, address, and contact details

- Buyer's info – Name and address

Invoice Details

- Invoice number

- Date – When the invoice was created

Product/Service Information

- Description – The products or services

- How much – Quantity, unit price, and total amount

Tax Information

- Tax – Goods and Services Tax (GST) details

- Total amount (including GST)

Figure:Example of Tax Invoices Eftpos Payment Receipt

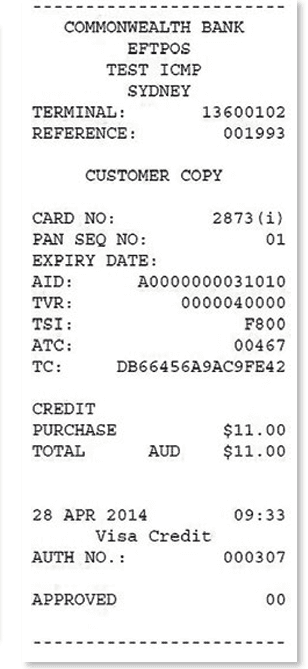

An Eftpos Payment Receipt is a document confirming that a payment has been made through an Electronic Funds Transfer at Point of Sale (Eftpos) system.It acknowledges the successful completion of a transaction.

It usually shows information:

Transaction Details

- When – Date and time of the transaction

- How – Payment method and card type

Business Information

- Who – Merchant's name and contact information

Amount Information

- How much – Total amount paid

- Approved or declined – Confirmation of payment

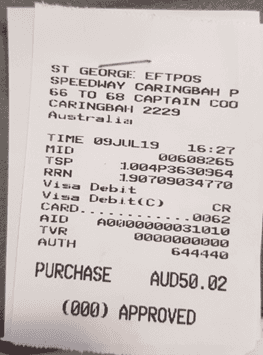

Figure: Example of Eftpos Payment Receipt Spot the difference

Purpose Content Legal Requirement Tax Invoice Primarily for tax and accounting purposes Detailed information on products/services, taxes, and payment terms Often required by tax authorities for proper documentation Eftpos Payment Receipt Confirmation of payment Focuses on transaction details, amount, and payment method Serves as a customer receipt, not always legally mandated For businesses, maintaining tax invoices is a must for keeping solid accounting records and claiming tax or GST.

Eftpos payment receipt is helpful and supplementary, especially when you've paid more than the invoiced amount (such as credit card surcharges).

However, it's essential to note that while the Eftpos receipt confirms payment, it can't replace the role of a tax invoice.

The invoice is the official record that details why and where you spent that money, making it irreplaceable for comprehensive documentation.

Figure:✅ Good example - Tax invoice submitted with Eftpos receipt together

Figure:❌ Bad example - An Eftpos receipt doesn't tell you details on its own, and can't be used for tax deductions. Tracking expenses can be a painful process of accumulating receipts and entering them into outdated systems... but there is a better way.

Various apps help solve the above problem. Using a modern Accounting system such as Xero, some connected apps can be used in conjunction with the accounting system and they include:

It may be difficult to determine which app would be best suited for your business so below is a comparison of some of the major features of each app.

There are 2 main purposes when evaluating an Expense app:

- Reimbursements - When you are at the shop and you pay for something personally and want the app to take a photo and send it to the office and later see the $ come back into your account.

- General expenses - When you are at the shop and using the company credit card, you don't need reimbursement, but you do need to give accounts a photo of the receipt and the purchased item.

Product Xero Me Expensify Hubdoc Pricing $5 per active user/mo $840/year (minimum) ✅ Free with Xero Submission Procedure ✅ Phone App – take a photo and submit it through the app ✅ Same as Xero Me ✅ Same as Xero Me Restriction on Invoice uploads ✅ Unlimited ✅ Unlimited ✅ Unlimited Back-up ✅ Unlimited - use cloud backup and security. Never deletes ✅ Unlimited – Never deletes and remains archived ✅ Unlimited – use cloud backup and security. Never deletes Organizing ✅ Organized on user-submitted, expense type or date order Can be manually organized into folders or reports Requires greater security privileges than uploader only. Automatically organized into folders (can be updated) Expense Rules Automate rules (or after the first occurrence) as to where expenses are to be accounted to (account categories) ✅ Same as Xero Me – little easier to navigate to the section Same as Xero Me – however seems to only be on each invoice (can't create outside of existing invoice - not that important) Accounting Codes ✅ Syncs with Xero account categories and automatically chooses those options. Brings bank reconciliations of these invoices to 90% of the way Only available on the subscription plan of $1800/year ✅ Same as Xero Me Phone Compatibility ✅ All phones ✅ All phones ✅ All phones Two-factor Authentication ✅ Yes No ✅ Yes How-to Videos Yes ✅ Yes - The most videos Yes Descriptive Notes ✅ Yes ✅ Yes Not available Bank Specification ✅ Yes Not at $840/year ✅ Yes Overall, the winner is Xero Me. The design of the Xero Me app provides all the user experience to enable simple and convenient reimbursement requests or company spent money receipts for reconciliation.

The best feature of Xero Me reimbursement is that the employee's bank details are automatically assigned when they submit a claim. The approver (Accountant or Business Owner), approves of the expense, it will be generated as a payable invoice in the 'Bills' section of Xero and dealt with like any other bill.

Although Expensify is capable of performing this function, it is expensive.

Expense apps are a timesaver, both for the day to day user, as well as the accountant receiving the expenses.

As a user, all you have to do is take a photo of the receipt from your mobile app, file or add any comments (all other data is pulled in via OCR “Smart-scan”), then all of these expenses get batched together and sent on a weekly basis to the accountant, who can then manage them in bulk.

As an added bonus in Xero Me, employees can also see their leave entitlements and payslips.

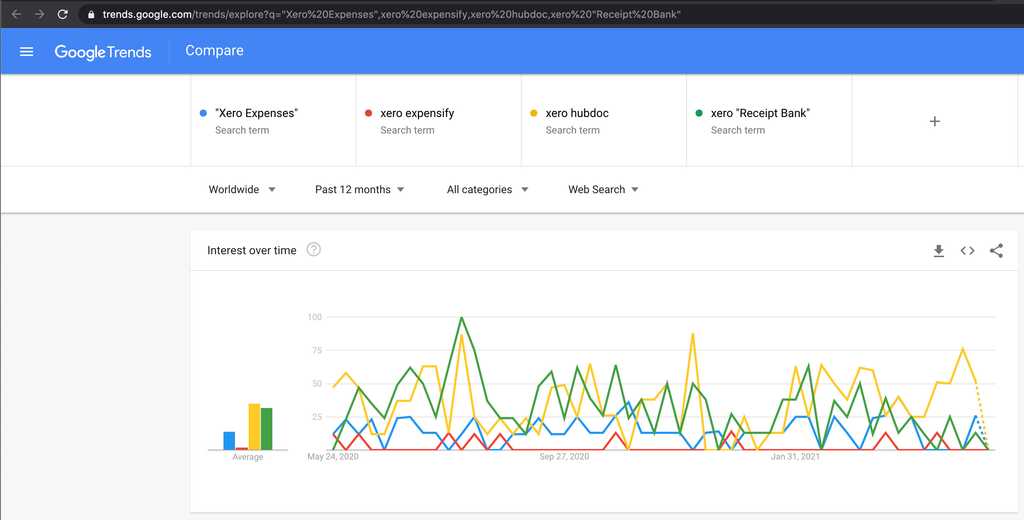

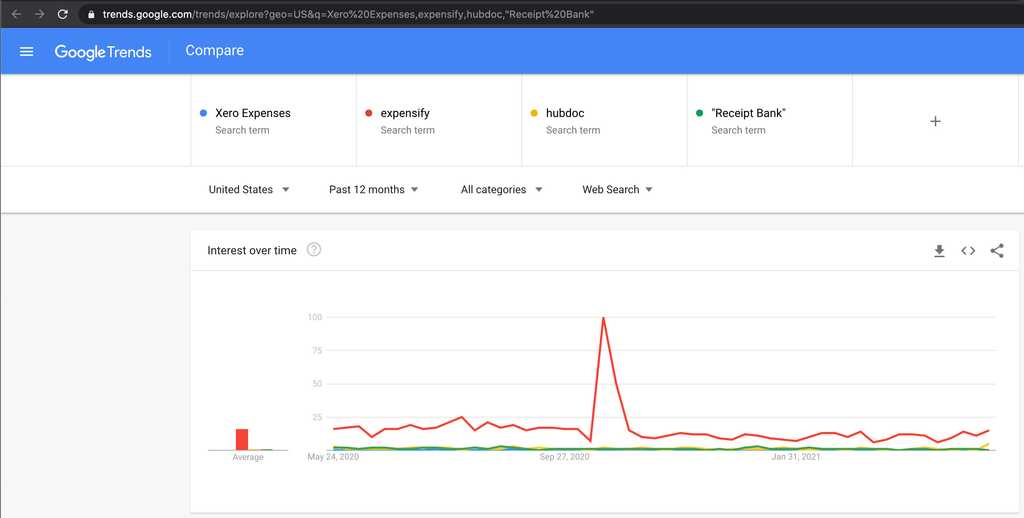

The most popular expenses apps

With Xero

Figure: Google Trends (May 2021) show that Hubdoc and Receipt Bank are the most popular apps More at Google Trends.

Without Xero

Figure: Google Trends (May 2021) show Expensify as the most popular More at Google Trends.

There are several factors to consider when choosing the right expense receipt system, such as:

- Frequency which a reimbursement is made (daily, weekly, monthly etc.)

- Number of employees approved to request expense reimbursements

- Value of expenses allowed to be reimbursed (minor, major or any values)

- Subscription cost of system

- Integration capabilities with Accounting Software

It is recommended to use the Xero Expense app in tandem with the Xero Accounting software because this combination makes it simple to perform reimbursements and has a high level of customer satisfaction.

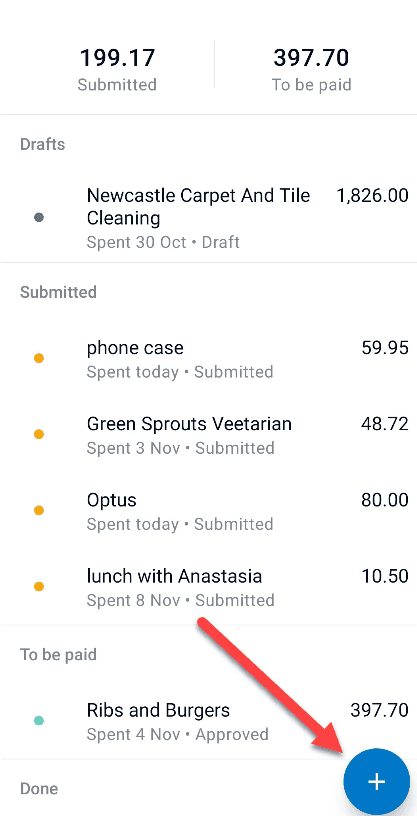

Steps to completing an expense reimbursement

Employees

- Open the Xero Expense mobile app and submit a photo of the receipt for reimbursement or filing. For digitally emailed receipts, you can either take a photo of the email and upload it as per usual or you can upload the PDF version of it within the app.

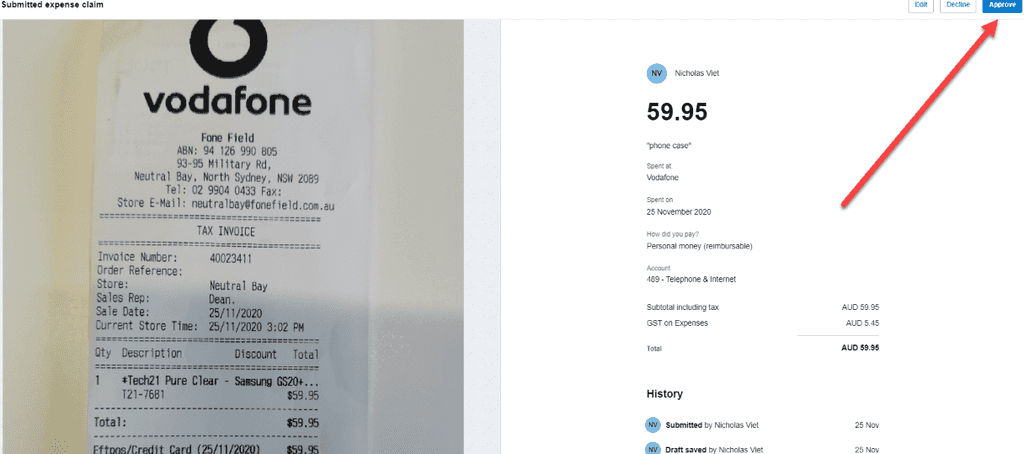

Figure: Xero Expense app submit a photo - Either allow the app to analyse the details automatically or enter the details yourself (if you are strapped for time, you can take a photo and come back to it or hold on to the receipt and attend to it when possible)

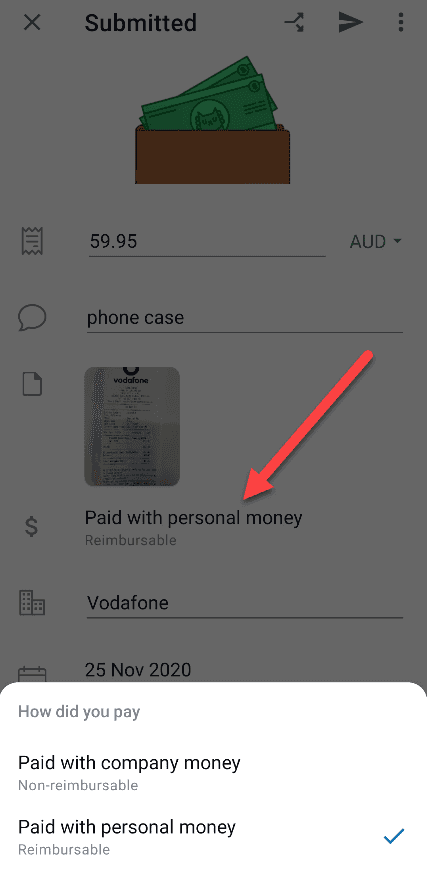

- Confirm whether the expense was paid personally or with company money

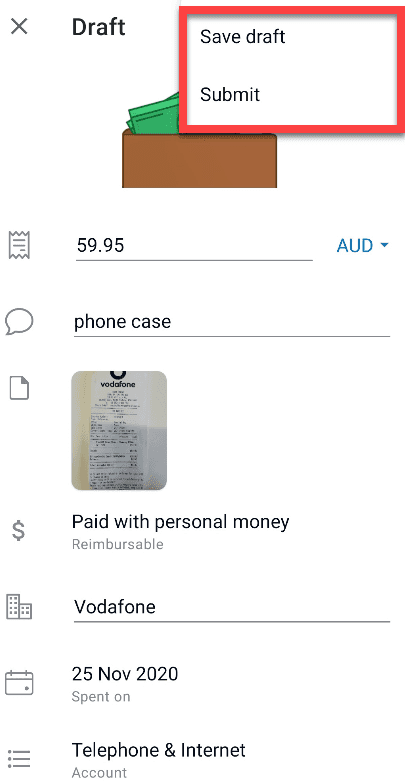

Figure: Option of reimbursable and non-reimbursable - When all details have been checked and are complete, click submit for approval and then wait to be reimbursed. If you are not ready to submit and run out of time, you can save as draft and get back to it by the next day

Figure: Saving as draft or submit for approval Note: if not already done, make sure purchase approval is forwarded to the Accountant or included in the photo submitted.

Accountant

- Review the Xero Expense claims weekly

- Complete a general check of the receipt details

- Follow-up on any invoices awaiting approval, or obtain approval where appropriate

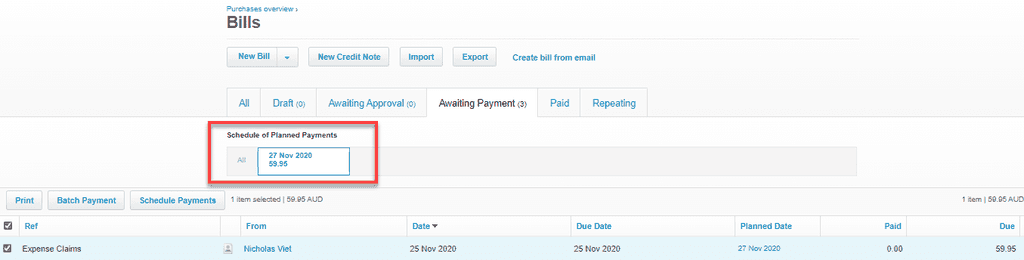

Figure: Xero Expense claim approval page - Schedule for reimbursement to be in line with the upcoming pay

Figure: Xero payment scheduling page - Submit the reimbursement along with wage payments

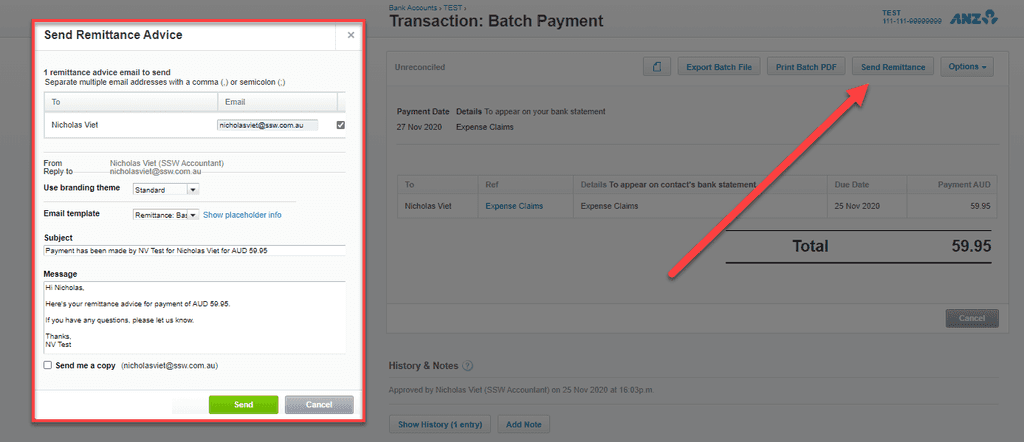

- Send remittance to employee via Xero

Figure: Send remittance page post payment When a company manages its small expenses, it is common to let the employees use a company credit card to avoid staff being blocked by reasonable purchases after appropriate authorization.

Accountants are aware of the risks that come with sharing one credit card amongst multiple employees as transactions often become unaccountable as well as presenting opportunities for unauthorised use. However, issuing credit cards to each employee also brings pain due to extra administrative overhead and the increased risk of lost/stolen cards.

To simplify expense management and improve financial processes, we encourage the use of Apple/Google Pay for company expenses. Adopting virtual wallets as the preferred payment method for in-store purchases streamlines expense management, increases accountability, and improves company expenditures management.

Efficient Expense Tracking

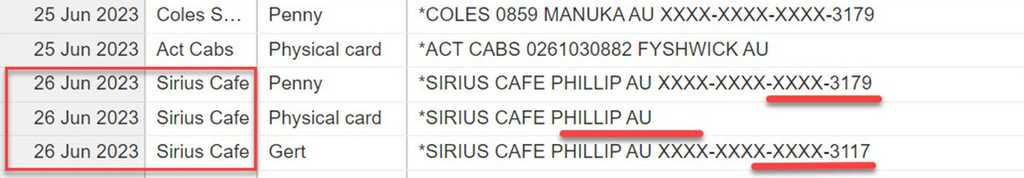

Each Apple Pay / Google Pay will have a unique card number and will always show on the bank statement when making EFTPOS purchases (in-store purchases), and accountants will know who made the payment.

For example, here are 3 purchases from the same vendor at the same time. By referring to the unique card number from the statement, it can be determined that 2 payments were made by different staff members, while 1 of them was paid with a physical credit card.

Figure: By implementing virtual cards, purchasers’ information can be taken from the bank statements Apple/Google Pay provides a centralized and easily accessible record of transactions. Each purchase generates a digital receipt, capturing important details such as the date, time, amount, and vendor information. This streamlined record-keeping simplifies expense tracking and reduces the administrative burden of manual expense reporting. Integrating Apple/Google Pay with expense management software allows for seamless synchronization of transaction data, providing real-time visibility into expenditure patterns

Enhanced Security and Fraud Protection

Apple/Google Pay incorporates robust security measures to protect against fraud and unauthorized transactions. Tokenization and biometric authentication ensure that only authorized individuals can initiate and complete transactions. By encouraging staff to use Apple/Google Pay, we can mitigate potential financial risks and safeguard company resources.

Scenario: Everyone share the same credit card detail, hard to know who made the purchase.

Bad example

Scenario: Everyone receives a physical card, with each of them having independent card details (a risk multiplier). The accountants know who paid the money, but hard to manage them and easy to get hacked.

OK example

Scenario: Everyone can access funds through Apple/Google Pay without creating separate credit cards, and the payment must be approved through the phone with biometric authentication.

Good example

There is also an option that company can manage those expenses through third parties.

✅ Pro: They usually provide good reporting, customized credit limits and are good for controlling your budget. ❌ Con: It can be costly, carrying the risk of potential financial loss if the third party faces bankruptcy and forfeiting your credit card rewards.

The business owners need to decide to take risks on the employee or the other business.

No Maintenance Fees

Apple/Google Pay is free. Physical credit cards may charge an admin fee, but they can be avoided by switching to Apple/Google Pay.

Integration with Expense Management Systems

Virtual credit cards seamlessly integrate with various expense management systems, facilitating streamlined expense reconciliation and reporting. Linking Apple/Google Pay transactions directly to expense reports automates the reconciliation process and eliminates manual data entry. This integration provides accurate and up-to-date expense information, enabling comprehensive financial reporting and analysis. It also facilitates efficient auditing and compliance monitoring.

Keep Earning Rewards

When using Apple/Google Pay, you still get the same benefits and rewards as you do with physical credit cards.

Most bills in this modern age of technology are no longer mailed to a physical address and are accessible online.

The downside of this is that a business may have tens or hundreds of invoices each month and it would not be worth the time for a team or staff member to either login to the supplier portal to obtain the invoice or sift through layers of emails in a dedicated accounts/invoicing email, to then submit it to the accountant or into the accounting system.

Some systems or accounting add-ons would have an auto-fetch function. What this means is that whenever an invoice is generated, certain suppliers have made it possible for the system or add-on to bring in the invoice from the supplier platform to the system or add-on. This is called fetching of invoice.

As auto-fetch is in place, there should no longer be a requirement for any staff member to manually forward regular or periodic invoices to the accountant or to enter into the accounting system. These systems and add-ons can be organised or set-up in a way to automate the majority of the steps from fetching the invoice to the payment or reconciliation of these invoices in the accounting system.

The level of automation can be customised in a way so a staff member can get involved at a certain step to do a manual check, or alternatively, the invoices can be automated from start to completion without any manual work.

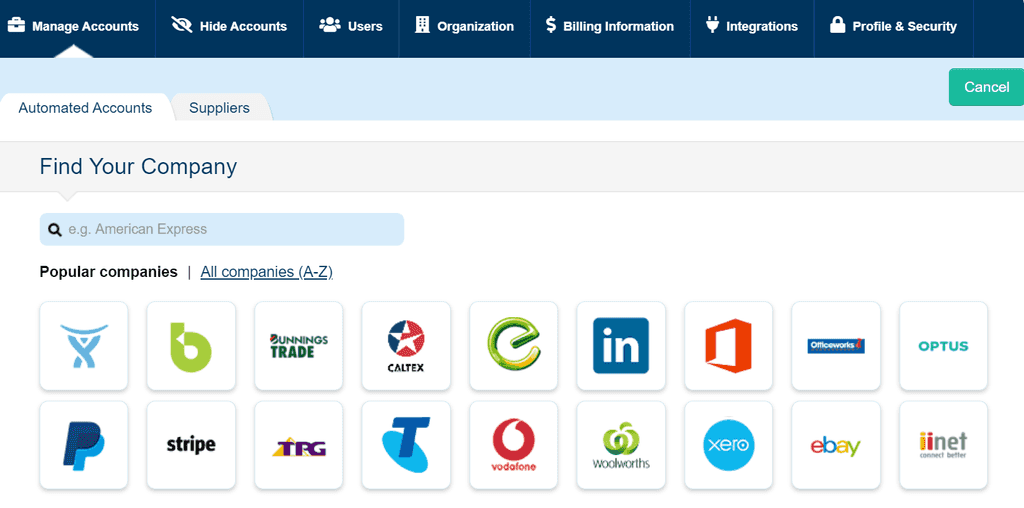

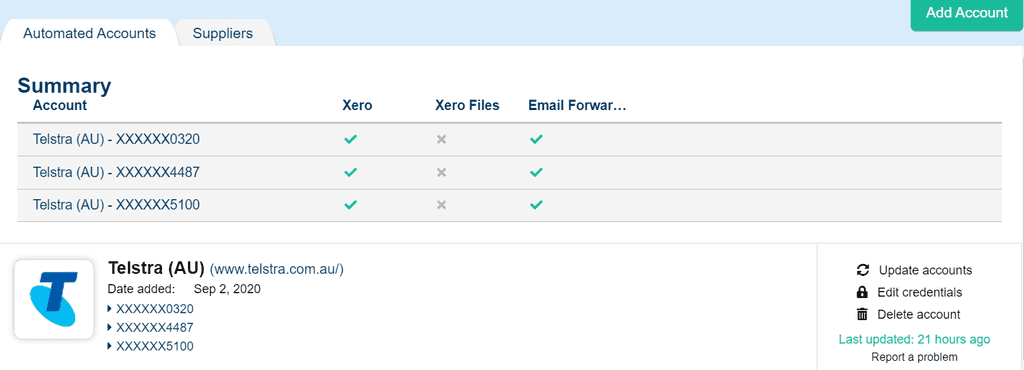

At SSW, we use Hubdoc which integrates with our accounting platform (Xero) and has some of the most Australian suppliers connected with the auto-fetch system, compared to its competitors.

Figure: Popular suppliers with auto-fetch capabilities

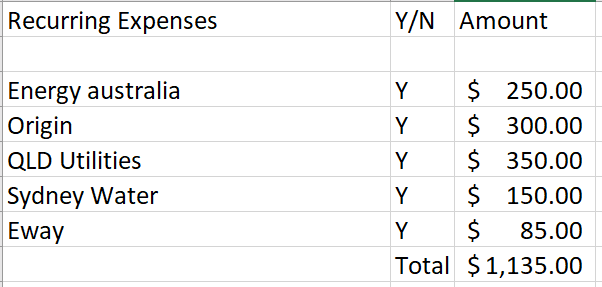

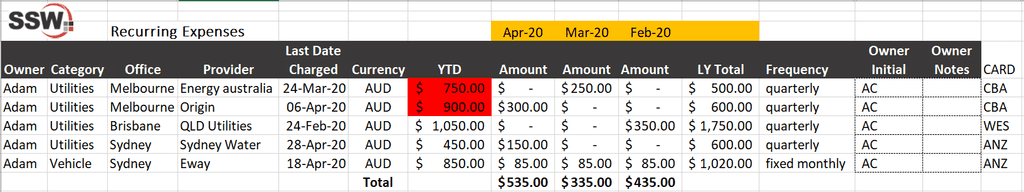

Figure: Confirmed auto-fetch accounts updated every 24 hours Subscriptions are part of the very fabric of everyday business, these include but are not limited to phone bills, rent, software subscriptions and many more. Businesses can commonly become unaware of the real costs of subscriptions, especially to those businesses that enter in a direct debit system with their suppliers. Have you ever been prompted to look at the cost of a subscription and asked yourself, "since when has this subscription cost gone up two times?"

We strongly believe in the benefits of accurately tracking recurring subscriptions both for cash flow purposes and for avoiding surprises down the track.

It may be the subscription was entered many years ago and you have yet to revisit it since and likely missed the emails of automatic increases somewhere in your many thousands of emails in your inbox.

With technological changes, comes a greater need to focus on tracking your subscriptions before it becomes a problem for the business or an unpleasant surprise.

A common solution many business owners used to solve the issues of tracking is by delegating the responsibilities to their finance team or accountant. This is a big assumption that they follow accurate and proper due process when completing the regular tracking procedures.

- Do they follow a proper process in tracking by using a tool or software? Excel is a great simple tool which all businesses can use successfully.

- Is there an agreed time each month, to review and update the dataset from the tool?

- Does the dataset make it simple to pinpoint when significant or unusual changes have occurred? Example includes increases in subscription costs or non-payment of a subscription. With excel, we recommend the use of formulas and conditional formatting to ensure these occurrences can be pinpointed.

- Can the dataset extract information on the owner and the total cost of the subscription?

- Has the owner of each subscription provided their initials or confirmation each review period, that the subscription is accurate and as expected?

Figure: Good example - All useful information is maintained and conditional formatting is used to identify significant changes There is no foolproof process that will avoid every unwanted situation, however, by following proper expense tracking will ensure these situations are discovered before it becomes a major issue and it may provide more reporting layers in order to make better financial decisions.

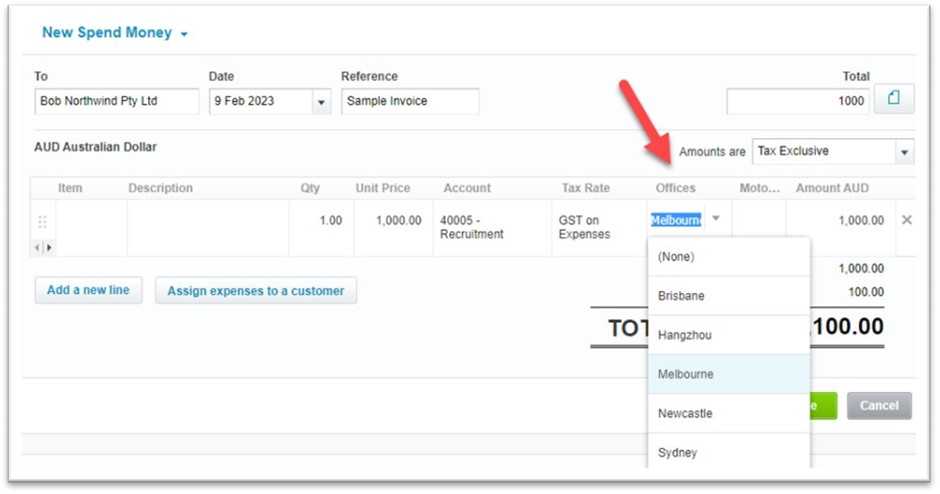

When a company has multiple offices in different locations, it is important to allocate expenses to each office accurately to ensure that the financial reports reflect the true costs of running the business in each location.Proper expense allocation can also help identify areas of inefficiency and improve cost management.

However, allocating expenses to offices in different locations can be challenging, especially when the expenses are shared among different offices or are difficult to track.It requires a systematic approach and a set of guidelines to ensure that expenses are allocated fairly and accurately.

Direct allocation of expenses

If an expense is attributable to a specific office, it should be allocated directly to that office.This includes expenses such as travel expenses incurred by an employee visiting a specific office or recruitment costs for a particular job opening in a specific office.

E.g. If there is a recruitment ad for an open position in Melbourne with a cost of $1,000, it should be allocated to the Melbourne office.

The office chosen should genuinely reflect the beneficiary.

- If Bob travels from Sydney to Brisbane to give a speech at a conference held by the Brisbane office, the cost should be allocated to Brisbane

- If Bob travels from Sydney to Melbourne for training, then the cost is allocated to Sydney

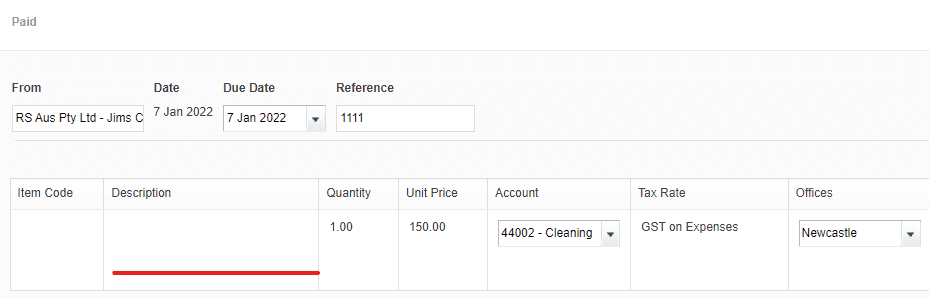

Automated tools, like accounting software, should be used to streamline the allocation process and reduce the risk of errors.Accounting software, such as Xero, provides the option to include an office for transactions; however, some overhead costs need to be manually allocated based on a certain rate.

Figure: Office can be assigned on each transaction in Xero Allocation of shared expenses and unassigned expenses

If an expense is shared among multiple offices and cannot be directly attributed to a specific office, an administrative rate should be used to allocate the cost across all offices.The method for calculating the administrative rate should be clearly defined in the company rules. Examples of administrative rate calculation methods include the cost of sales or headcount.

E.g., if there is a recruitment ad for a position advertised for any office, the cost is not directly allocated to a specific office but is instead allocated by an end-of-month adjustment.

Unassigned expenses will be tracked separately and allocated to each office by an end-of-month adjustment. See the figure below. The allocation frequency should be clearly defined in the company rule.Expenses from the company level can be allocated to each office based on the admin rate which can be calculated by different methods. E.g. Cost of sales.

- These expenses will initially be treated as unassigned when created

- A manual journal will be created by the end of the reporting period

Figure: Good example - Software expenses from the company level would be assigned to different offices based on the admin rate Review and Communication

The allocation process should undergo a review by someone with accounting expertise to ensure the accuracy and consistency of the allocation results.

The company rules governing the allocation process should be effectively communicated to all relevant parties.

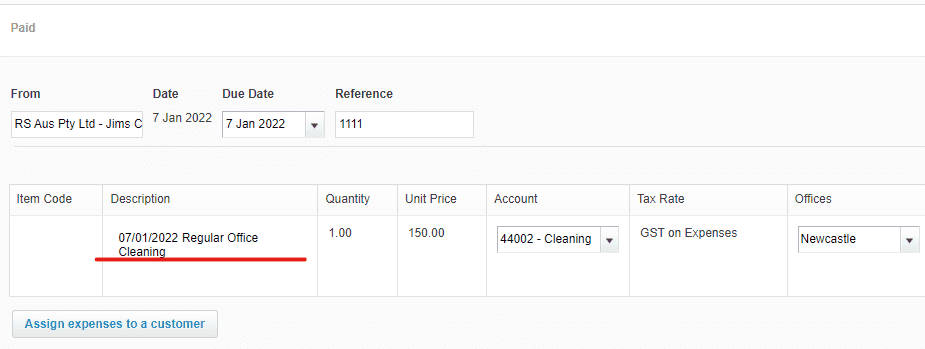

It is always a good idea to provide more details when submitting an expense claim or recording an invoice. This helps to ensure clarity and avoid any confusion in the future.E.g. The period the invoice relates to.

Make sure to include the following details as much as possible:

- The purpose: Clearly state what was for.

- Relevant project or client information: This helps with tracking and allocation.

- Authorization details: If it requires approval from someone, mention who authorize it.

- Supporting documentation: Attach any necessary documents that validate it.

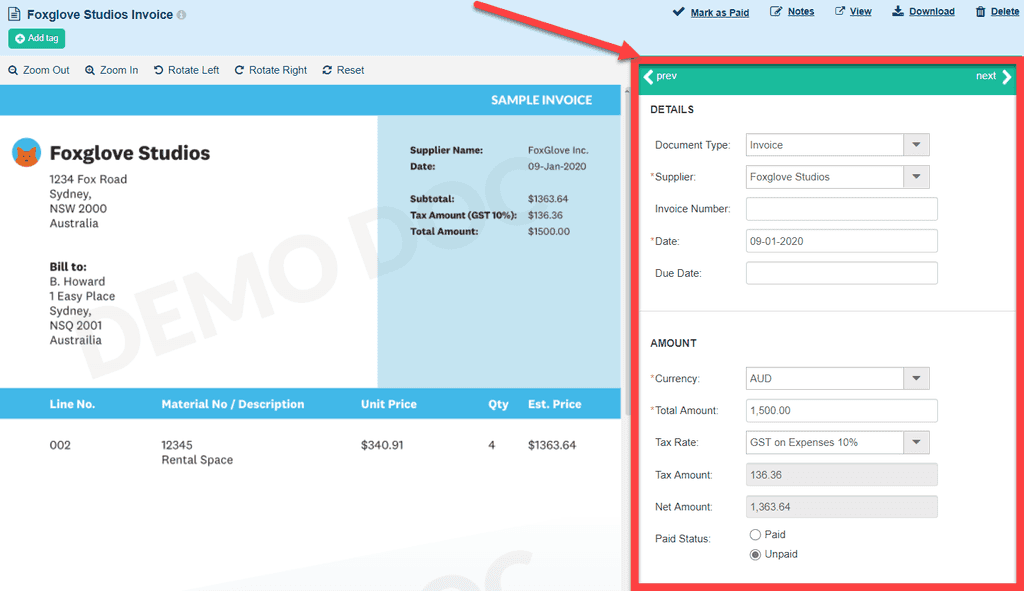

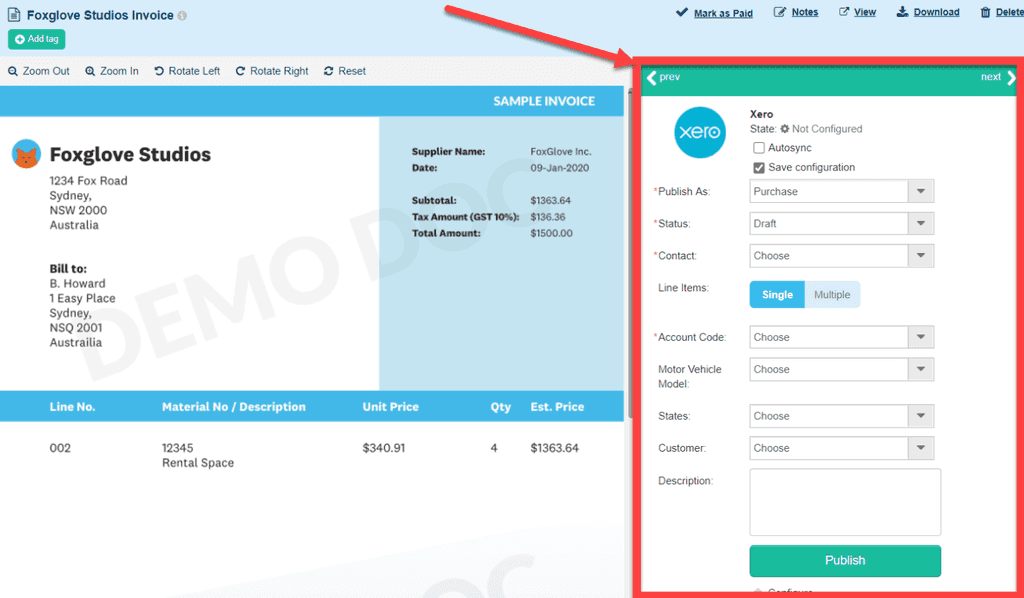

Figure: Good example - A detailed description Hubdoc is great for tracking and accounting for receipts, but if you don't use it in the right way the reports can be made more difficult to reconcile.

To avoid confusion, add as much detail as possible about the purchase and who authorized it. To make this easier, your company can set some required fields to ensure that you have all of the relevant data entered for each claim. This will make your claims a lot more unified and easier to process.

Figure: Users to accept invite to use Hubdoc

Figure: Take a photo with the Mobile Hubdoc app

Figure: Photo of Receipt and submitting basic invoice details - generally is read by OCR of the software

Figure: Details that can be automated for Accounting reconciliation purposes The user or the administrator of the account can set up rules for each invoice in regards to their publication status and reconciliation details on the first instance. Going forward, any repeat of the invoice or the supplier will be filled in based on those rules set up.

There is still an opportunity to review all the details, so setting up rules will simply fill in the repeat details each time. This is to ensure consistency in the reconciliations and save time for both user and the Accountant.

Depending on the permissions of the User, they can also publish the invoice to Xero which can be recognised conveniently when completing the reconciliation process on Xero.

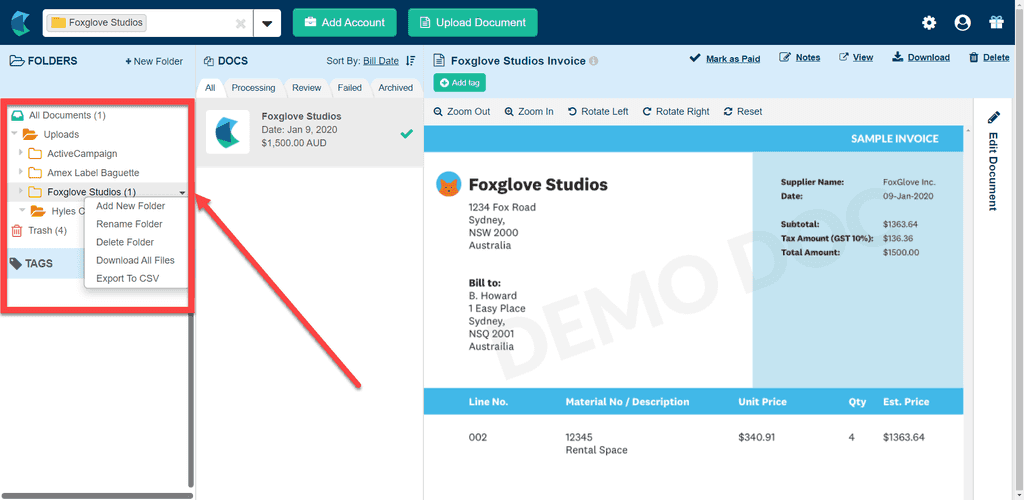

Tip: Hubdoc will automatically create folders to categorise the invoices and store for the user. These folders can be reorganised or renamed with ease. We recommend updating the folders early on so the invoices are collated in a useful manner for your business.

Figure: Folders in Hubdoc When an organisation grows and has multiple offices, corporate cards can be issued to the various office managers to provide relevant amenities for their respective offices.

Issuing cards can be both an administrative and financial burden. Administratively, the accountant needs to be able to reconcile the expenses incurred and ensure they are of business relevance. Financially, card limits and spend amounts needs to be checked and reviewed regularly to avoid overspending uneccessarily.

To assist the accountant with any administrative burdens, the office manager (or the office assistant) should record all receipts to the accountant within a week of the spend. The best way to file these receipts is to use the company's expense receipts app. This allows for the quick disposal of the receipts and the maintenance of a digital copy.

Note: If your business does not use any mobile app for expense receipts yet, review the comparison between 3 apps particularly useful apps and determine which app may be best suited for your business.

By using an expense app, the accountant obtains the digital copy of the receipt which should match to the relevant transaction in the bank statement lines within the accounting system and allow for faster reconciliations.

Depending on the rule of your organisation, office managers should have some level of approval powers e.g. up to $100 can be approved by the office managers. Other alternatives could be that 2 office managers together can approve up to $500 or alternatively everything must be approved by 1 person such as the accountant. Based on the rule, the expense app should be set up in a relevant manner so expenses are approved by the right person.

Making payments should not require too much admin and the systems in place should mean making payments becomes a standard process. Most businesses should have an accounts department to handle payments and supplier relationships.

It is recommended that you schedule payments through your accounting system and make payment on a regular and consistent period, for example, every Friday. This enables a more connected reconciliation of the books and a greater ability to manage supplier relationships and cash-flow.

Scheduled payments means you won't need to make individual payments through your banking portal at random intervals and you will be able to send remittances all at once at a regular time.

At SSW, we use our Accounting software (Xero) to schedule payments. All invoices and bills are either emailed or pushed through to the bill's section via an expense app (we recommend using either Xero Expense or Hubdoc app).

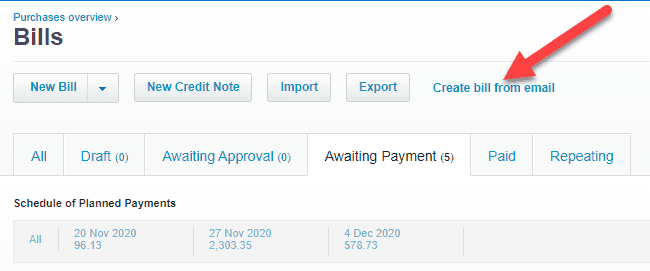

Figure: Use Xero's bill creation via email forwarding process OR

Figure: Use Xero Expense for capturing bills or money spent Once the invoice is in the bill's section, you can schedule a planned payment date.

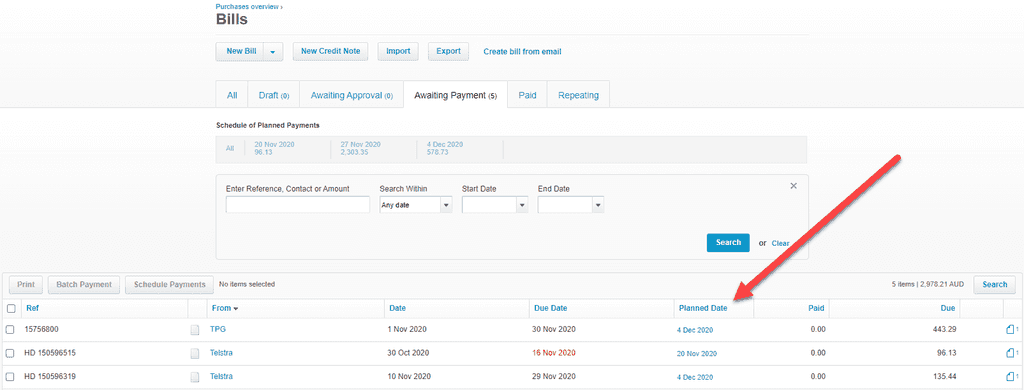

Figure: Scheduling area of unpaid bills It is important to have a usual day of payment, so the accounts department is able to follow the agreed terms for scheduling and maintain consistency throughout. At SSW, we batch our payments on a weekly basis to be paid on Friday. Additionally, the accounts team should agree on whether payments are made prior to the due date or a number of days following the due date.

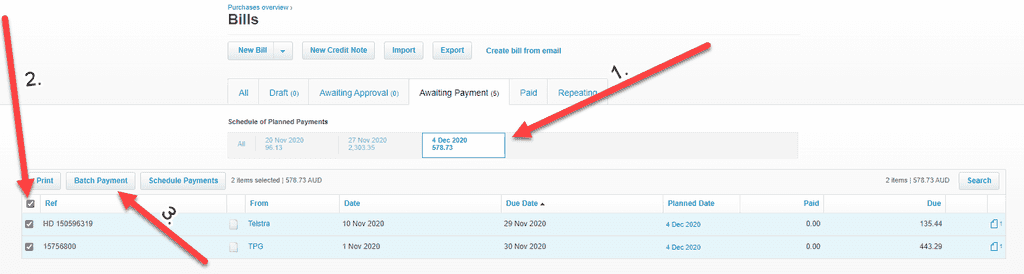

It is then super easy to make a batch payment on the day of payment. Simply select the relevant date under the schedule of planned payments and select all invoices to be batched and paid through your banking portal. There should be no restrictions to the number of invoices to be paid at any one time so the business should be able to make all the weekly payments in one go, saving countless amounts of time not needed to process invoices daily and earlier than required.

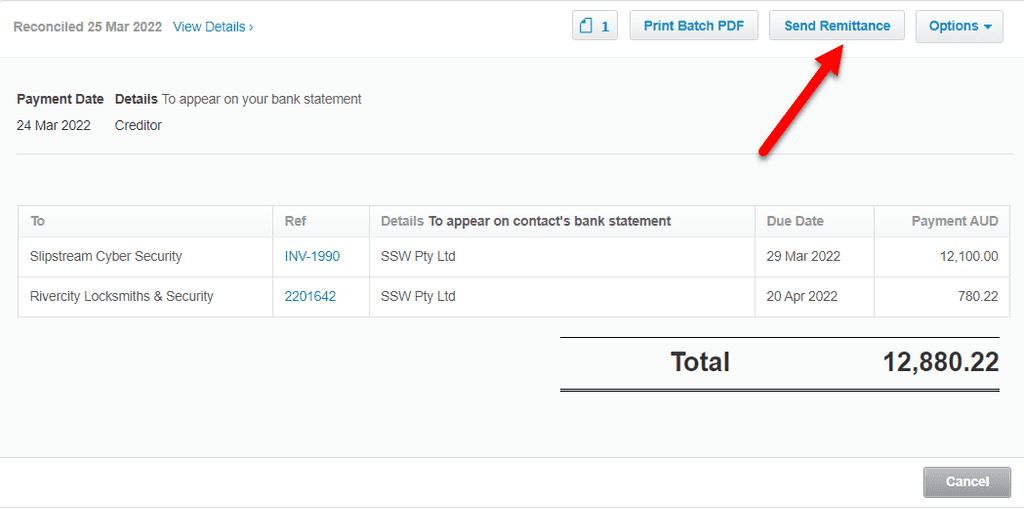

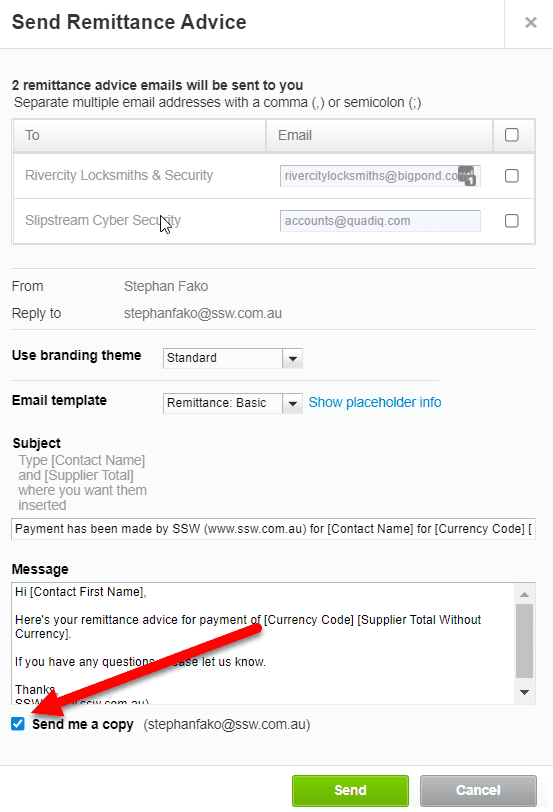

Figure: Prepare batch payment for scheduled payments on a specific date Another important aspect of creditor payment management is forwarding remittance advices to suppliers. When using bulk payment in Xero, the details that appear on the suppliers' bank statement might not be sufficient for the supplier to allocate the payment against the correct invoice or group of invoices. For this reason, it is highly recommended for the payer to forward remittance advices to respective payees immediately after payments have been arranged.

Figure: Emailing Remittance Advice from Xero It is a good practice to email the remittance advice directly from Xero. This will leave an audit trail in Xero and will enable you to quickly identify it the remittance advices were sent. If any suppliers have queried the payment before the payment was arranged, consider replying with a done email - "Done - made the remittance, see other email from Xero with the remittance advice".

In some instances, such as replying to an email sent by a staff member of your organisation, it might be preferable to attach the remittance advice pdf to the email reply rather than to email the document directly from Xero. Xero does not have a download option for remittance advices. However, the remittance advice pdf can be emailed to the Xero user and the user is then able to attach the document to the email reply. Ensure to untick suppliers when emailing the documents to the Xero user.

Figure: Emailing the remittance advice to the Xero user's email address Note: All scheduled payments should ideally have an attached PDF of the invoice, as represented by the image of a paper document on the end of each transaction. This is useful for auditing purposes and referring or double-checking.

In terms of cash-flow planning, it is useful to know the payment amounts that are expected to be paid on a certain date. This helps to avoid any surprises and assists in knowing the amount of cash available to be spent up to a certain date (after considering bills payable).